Article Contents

Strategic Governance in Family-Owned Businesses: Aligning Family Values with Marketing and Supply Chain Performance

⬇ Downloads: 26

1College of Business, Al Yamamah University, Al Khobar, Kingdom of Saudi Arabia

Received: 11 September, 2025

Accepted: 03 December, 2025

Revised: 29 November, 2025

Published: 08 December, 2025

Abstract:

Background: Family-owned businesses (FOBs) are essential to the UK, as they are characterised by family values, long-term orientation, and governance structures. Although UK FOBs are economically relevant, most of them fail to strike a balance between conventional family control and the need to operate under formal governance systems to improve their competitiveness and operational effectiveness.

Aim: This research article aimed to explore the effect of strategic governance on marketing and supply chain performance through the mediating effect of family values in family-owned businesses (FOBs) in the UK.

Methods: The current research adopted a primary quantitative research design, in which data were collected using a structured survey questionnaire from 384 supply chain and marketing managers at FOBs. The data were analysed using Partial Least Squares-Structural Equation Modelling (PLS-SEM) in SmartPLS.

Findings: The study found that strategic governance significantly impacted marketing performance (β = 0.525, p = 0.001) and Supply Chain Performance (β = 0.454, p = 0.001). The study also revealed that family values partially mediated the association between Strategic Governance and marketing and supply chain performance. Results indicate strong direct effects in model pathways, with all values highly statistically significant and strong explanatory variables. Contributions through family values also existed indirectly, which validates the applicability of cultural mechanisms that demonstrate the role of UK FOBs in enhancing competitiveness when traditional family principles are successfully incorporated into performance-based decision structures.

Implications: Family businesses need to recognise the role of formal governance systems, despite having traditionally used informal, trust-based governance. Second, family values should be incorporated into the policy framework of governance, where business strategies are established within the enterprise’s cultural identity and history, thereby creating a competitive advantage.

Keywords: Strategic governance, family-owned businesses (FOBs), family values, marketing, supply chain, performance.

1. INTRODUCTION

Strategic governance in FOBs intersects with intensely integrated family values and the necessity for competitive outcomes and business performance (Randerson & Radu-Lefebvre, 2021; Khan et al., 2022). Regarding the economic influence of FOBs in the United Kingdom (UK), they contributed £985 billion to the country’s GDP in 2021 and approximately employed 16 million workers (CEBR, 2025). Most of the market leading firms, including Wittington Investments, Pentland Group PLC, and James Dyson Ltd, hold significant ownership and control within the firm that are characterized by family ownership and control of majority of the equity and the voting rights (FBU, 2025). This is an indicator of how the family greatly affects strategic and decision-making related to governance (Schweiger et al., 2024).

According to (Sadiq & Gebba, 2022), FOBs typically centre their governance on family-centric norms, such as socio-emotional wealth, long-term orientation and legacy. However, (Harjito et al., 2021; and Huseyin, 2023) found that structured governance mechanisms, comprising formal policies and boards, tend to enhance financial performance when developed and applied effectively, aligning with the company’s strategic objectives. On this note, (Barzegar & Alavi, 2023) also explain that effective strategic governance is also a supervisory administrative tool and is an integrative and vital tool in aligning the family values with the market requirements when running the businesses.

Moreover, (Anatasia et al., 2023; and Qi & Mohammad, 2024) indicate that the family commitment has a positive effect on the innovation among firms that eventually leads to better market performance in the form of customer satisfaction, market demand, and market share. On conflicting grounds, yet stating that this effect depends on how the governance facilitates experimentation, research and development without undermining the control, (Oluwatukesi et al., 2023) express that this is a tension between upholding legacy and at the same time, incubating innovation. In addition, (Sorenson & Milbrandt, 2023; and Ahmad, 2025) stated that the family values are an effective brand asset, which includes authenticity, reputation, and loyalty. The author also divulged that in terms of marketing, such brand assets result into differentiated and unique products in a saturated or competitive business environment. Nevertheless, (Gamble et al., 2021) found out that FOBs are less tech-savvy and brand-conscious. They will not invest enough in technologies or online marketing, limiting access to customers and responsiveness. The findings are also indicative of a significant gap in the research of the extant body of literature, since the process through which strategic governance structures in FOBs are related to the conversion of family values into measurable results, e.g., better supply chain and market performance, is under-researched.

In addition, supply chain processes are also heavily impacted by family values through relational norms, such as trust-based relationships with suppliers and local sourcing. In this regard, (Debellis et al., 2024) found that trust enhances resilience and cost performance across dimensions such as innovation, agility, and reliability, which are essential components of effective supply chains.

The private sector of the United Kingdom is dominated by Family-Owned Businesses (FOBs), which make up 85% of all firms and contribute substantially to the country’s GDP and employment (CEBR, 2025). Though their structures of governance usually remain conventional, formed by massive family-controlled ownership and governance practices driven by family legacy, with restricted adoption of formal mechanisms of oversight or digital integration. In the UK, where regulatory frameworks focus on accountability and transparency, such informal mechanisms of governance tend to obstruct the competitiveness and efficiency of marketing and supply chain operations. Although the topic of FOBs strategic governance is crucial and guarantees its long-term sustainability and performance, little research has evaluated how strategic governance in FOBs of the UK interacts with family values and affects dual performance outcomes in the context of the supply chain and performance (Jum’a et al., 2021; Kyere & Ausloos, 2021; Lee et al., 2023; and Lyon et al., 2025). This is one of the critical research issues that the present study deals with.

The current study makes significant contributions in empirical, theoretical and practical dimensions. In terms of empirical contributions, the current study offers rare evidence in the UK FOB context on the causal relationships among strategic governance, family values, and marketing and supply chain performance outcomes, an area underexplored in recent studies. Moreover, in terms of theoretical contributions, the current study advances socioemotional wealth (SEW) theory and agency theory by placing family values as a mediating factor that links governance structures with tangible business outcomes in the marketing and supply chain area. It expands on the research of (Sánchez-Marin et al., 2024) on the effect of finances. practically, the present research suggests the leadership and policymakers of FOBs to adopt a balanced approach between the traditional approach and professionalism by integrating the organised governance systems with the association with family values.

1.1. Aim

The aim of the study is to analyse the impact of strategic governance on marketing and supply chain performance, both directly and through the mediating effect of family values, within these relationships in the context of UK FOBs.

1.2. Objectives

- To evaluate the effect of strategic governance mechanisms on marketing performance in UK family-owned businesses.

- To assess the impact of strategic governance on supply chain performance within the UK family business context.

- To determine whether family values mediate the relationship between strategic governance and both marketing and supply chain performance.

2. LITERATURE REVIEW

2.1. Hypothesis Development

To examine the relationship between the strategic governance factors and the firm performance factors mediated by market orientation factors, (Kazemian et al., 2022) carried out research on the hotel industry of Western Australia. The author found that supply chain efficiency, manifested through shorter inventory turnover cycles and lower ratios of logistics costs, is a key way of improving corporate sustainability. Also, the results showed that increased digitalisation and well-developed internal governance positively enhanced the positive association amidst the governance and supply chain performance. The same results can also be observed in the research by (Nagalingam et al., 2022), which concluded that efficient governance frameworks allow optimisation of the resource allocation process and enhance the transparency of operations, supply chain efficiency, and compliance. In this view, (Liu et al., 2023) further observe that Global supply chain strategies such as procurement management and optimisation, and better logistics operations are also implemented through high-quality internal governance, but this is useful in responding to risks related to supply chain disruption. Moreover, (Klumpp et al., 2018) hypothesised that proper governance frameworks in companies contribute to enhancing the power of the firm to regulate the data in the supply chain and make the supply chain system more stable, which significantly affects the supply chain performance.

The previous studies are consistent in demonstrating that strategic governance is a positive influence on the performance of the firm, and is often mediated by the process of market or customer orientation. This study by (Kazemian et al., 2022) proved that financial and non-financial performance has improved due to the existence of better governance structures in the Australian hotel industry, and (Wasdani et al., 2021) showed that customer orientation is capable of improving satisfaction. Although these studies focus on the relationship between governance and performance, they are limited by industry specific experiences and most of them fail to include the role played by family in decision making process. In addition, the two research articles fail to comment on the complexities of family-owned enterprises, where governance is deeply rooted in family values and socioemotional aspects. These results combined suggest that the concept of mediation is essential. However, the current literature is inadequate for understanding the impact of family values on the efficacy of governance in performance. This gap underscores the need to explore strategic governance in UK FOBs, taking into account family values as a mediating variable to determine their effects on marketing and supply chain performance. Therefore, the strength of the current study lies in connecting governance with market-related outcomes such as supply chain and marketing performance in the case of UK FOBs, which leads to the development of the following hypothesis:

- H1: Strategic governance mechanisms have a statistically significant positive effect on the marketing performance in family-owned businesses in the UK.

(Li et al., 2025) conducted a detailed study to investigate the impact of strategic governance factors on the supply chain performance of Chinese listed firms, utilising 8,000 observations from 2010 to 2022. The author concluded that enhancing supply chain efficiency, as evidenced by shorter inventory turnover cycles and reduced logistics cost ratios, substantially increases corporate sustainability. In addition, the findings revealed that greater levels of digitalisation and robust internal governance substantially strengthen the positive relationship between governance and supply chain performance. These findings are also reflected in the study by (Nagalingam et al., 2022), which found that effective governance structures enable optimised resource allocation, improve operational transparency, and ensure supply chain efficiency and compliance. In this perspective, (Liu et al., 2023) also note that high-quality internal governance enhances the implementation of more scientific and efficient supply chain strategies, including procurement management and optimisation, as well as improved logistics operations, all of which are valuable for addressing risks associated with supply chain disruption. In addition, (Klumpp et al., 2018) theorised that effective governance structures within firms help improve the firm’s ability to manage supply chain data and make the supply chain system more resilient, substantially impacting supply chain performance.

According to existing studies, strategic governance is effective in improving supply chain performance through efficiency, transparency, and risk management. (Li et al., 2025) showed that strong governance in Chinese listed companies shortens inventory turnover and reduces logistics expenses, thereby enhancing sustainability. Equally, (Nagalingam et al., 2022) highlighted that effective governance systems are the best indicators for streamlining resources and ensuring operational transparency to ensure compliance and smooth supply chain processes. Another postulation made by (Liu et al., 2023) concerns the fact that proper internal governance would enable the application of scientific methods to the supply chain, which, in turn, would assist in eliminating the risk of disruption by optimising the procurement and enhancing its logistics. Despite the fact that these studies confirm the correlation between governance and supply chain performance, they predominantly are focused on large firms and do not relate to the specifics of family-owned firms, where the family values, traditions, and informal decision-making can influence the performance of governance. The gap indicates the need to investigate the effects of strategic governance, moderated by family values, on the supply chain performance of UK FOBs. Based on these arguments, the following hypothesis has been developed.

- H2: Strategic governance statistically and significantly impacts supply chain performance outcomes in family-owned businesses in the UK.

Moreover, H3, which assumes that family values interfere the correlation between strategic governance and marketing and supply chain performance results, stems out of the Socioemotional Wealth (SEW) theory, which assumes that FOBs prioritize non-financial goals and elements like brand identity, quality, and continuity, and emotional bonds with customers (Temprano-García et al., 2023). These values are translated into strategic governance decisions, such as offering high-quality, reliable products and services to customers and improving its marketing performance through a high-quality brand (Salem & Hashem, 2023). In addition, agency theory also supports H3, highlighting that strong governance eradicates inefficiencies, whereas family values form the execution of governance mechanisms (Mariani et al., 2023). Therefore, strategic governance coupled with family values justifies trust and unity, which ultimately improve the supply chain and marketing performances of firms.

The concept of socioemotional wealth (SEW) has been widely used to theorise the mediating impact of family values in the relationship between governance and performance, and FOBs are more actively involved in non-financial objectives, that is, identity, continuity and emotional attachment (Temprano-Garcia et al., 2023). This view is helpful in showing the distinct advantages of FOBs; however, it holds the risk of missing possible trade-offs, including resistance to change or scaling inefficiencies. (Salem & Hashem, 2023) propose that family values may be converted into trustworthy governance behaviour that reinforces marketing performance, but they are still focused on branding outcomes in a limited manner. When defined by (Mariani et al., 2023), the agency theory is essential to reduce the number of inefficiencies by amalgamating governance, but it does not reflect the reality that values can be embedded in the family-based culture of FOBs. Therefore, the available theories shed light on complementary factors but not on integration in understanding how family values have a systematic moderating role in governance-performance effects. Based on these arguments, the following hypotheses are developed:

- H3: Family values significantly mediate the relationship between strategic governance, marketing, and supply chain performance in the UK.

2.2. Research Gap

There is a clear research gap in terms of investigating how strategic governance of UK-based family-owned businesses (FOBs) affects marketing as well as the supply chain performance in the context of being mediated by family values. However, studies such as (Patrick et al., 2022) have evaluated the governance structures in FOBs. However, the primary focus was on business performance or succession planning. Nevertheless, they have a tendency to ignore dual and functional role of governance on the supply chain performance, as well as on market competitiveness. On the same note, family values have been mentioned in numerous works, including (Xian et al., 2021; and Zapata-Cantu et al., 2023) among others, as applicable in business decisions. Nevertheless, empirical studies investigating the mediating change between governance and performance measures are very few.

Additionally, the correlation between governance practices that include board accountability, strategic clarity and oversight and business performance has not been given much focus in the UK context, and specifically in family-owned businesses (FOBs). This difference is especially important when relating to the predicaments faced by these companies in the context of the influence of the legacies, which is bound to vary clearly as compared to the forces experienced in highly competitive markets fuelled by innovations (Ghinizzini et al., 2025). This research fills the gap in the literature by concentrating on the direct effects of strategic governance on both marketing and supply chain performance. Also, it focuses on how family values mediate this relationship in the UK. It helps to overcome the gap between the structure of strategic governance and its actual application in FOBs. Further, it will also be helpful to build integrative models that take into account the complexity of social-cultural and operational specifics of such enterprises. Therefore, the research provides new ideas with theoretical and contextual content.

2.3. Conceptual Framework

Fig. (1) presents the conceptual framework that demonstrates the effect of strategic governance on the market and supply chain performance of family-owned businesses in the UK through the mediation of family values. The framework is founded on the Socioemotional Wealth (SEW) theory, which acknowledges that the various dimensions (continuity, family identity, and emotional attachment) shape priorities in decision-making in FOBs stressed by (Leopizzi et al., 2021; Oluwatukesi et al., 2023) also. These values can be both empowering and limiting to the governance, such as dedication to family values can reinforce long-term strategic planning, but excessive dedication can slow the responsiveness of operations and flexibility. The agency theory supplements this view in that good governance mechanisms minimise inefficiencies, provide accountability, and coordinate managerial behaviour with the goals of a firm, which was unveiled by (Khan et al., 2022) also in their study. The framework combines these theories by postulating that strategic governance enhances marketing and supply chain performance both directly and that family values influence the performance of such governance mechanisms indirectly, resulting in alignment between the strategic intent and the socioemotional priorities. This two-theory underpinning explains the avenues between governance, values, and operational performance.

Fig. (1). Conceptual framework of the study.

3. Materials and Methods

3.1. Data Collection

The data is collected using primary data collection methods, which include a survey based on closed-ended questions. The survey was conducted with representatives from FOBs operating in the UK, as the study is based on measuring supply chain and marketing performance in the case context of FOBs in the UK

As a primary data collection instrument, the structured survey questionnaire was chosen to get standardised responses on the key constructs of strategic governance mechanisms, family value orientation, marketing performance, and supply chain performance, which were assessed using the previously validated instruments and modified to consider the peculiarities of family-business settings. Each variable is measured by three items, which are further measured on a 5-point Likert scale from 1 to 5: strongly disagree to agree strongly.

A 5-point Likert scale (Appendix A) is chosen to provide comparability and consistency of the constructs and allow for a statistically sound analysis to be performed. The survey started with demographic questions, collecting information about the respondents’ position, age, gender, job position, department, and years of experience managing marketing and supply chain operations in FOB. To ensure the validity and reliability of each construct, several Likert-scale items were used to measure it. Strategic Governance was quantified by questions like “Our firm has strategic objectives that are clear and noticeable” and “The decision-making in the firm is transparent and accountable. Family Values consisted of such statements as Family values are a significant source of business decisions, ” and ” Emotional connection to the business affects the choices of operations. The parameters of the Performance of the Marketing were evaluated with the help of such items as: Our brand reputation has been improved in the last year, and Customer satisfaction has been enhanced as a result of strategic initiatives. Supply Chain Performance entailed that Supply chain processes are efficient and reliable, and our logistics operations respond effectively to disruptions. The instrument was pilot tested (N = 30 FOB executives) after the initial draft and was refined concerning wording, scale balance, and context relevance, thus clarifying the instrument, decreasing the level of ambiguity, and improving the quality of measurement. In addition, scholars in family business governance performed an expert review, ensuring content coverage, highlighting redundant items, and establishing the representativeness of all constructs.

3.2. Population and Sampling

To get a representative sample, purposive sampling was utilised as per (Thomas, 2022), focusing on executives with transparent governance, marketing, or supply chain management-related experience, which is important to get informed and expert respondent opinions. The participants were approached using social media professionals’ platforms like LinkedIn and official social media pages of FOBs operating in the UK. Almost 700 representatives were approached using informed consent, among whom 410 responded, with a response rate of 58.57%. Out of 410 responses, a data cleaning process was applied for the missing values and outliers greater than |z| > 3.29 as per the principles of (Carlier et al., 2021), which led to the elimination of 26 responses, leaving a final dataset of 384 valid responses, which can be deemed as an appropriate sample size. The professionals were approached using different networking features of professional platforms. For instance, on LinkedIn, we joined pertinent industry groups such as representatives of FOBs and also approached individuals who were supply chain and marketing managers at FOBs in the USA.

On the other hand, contacts were also made with different FOB owners or those playing multiple roles in the FOBs, which maximised participation in the study. In this manner, the study used various platforms to engage participants, which allowed it to eradicate selected biases. Online recruitment and the utilisation of LinkedIn lead to the self-selection bias because the respondents who are more digitally engaged or interested in issues regarding governance have a higher chance of responding. As per (Carlier et al., 2021), this could impact the sample representativeness as it might over-represent managers who have had a positive experience of governance or who have had a greater involvement in strategic processes. In turn, (Harjito et al., 2021) specify that the results are not generalisable to specific regions such as the rest of the UK family-owned businesses, especially those that are not well-digitised or work in more traditional management environments.

To evaluate non-response bias in the current study, an independent sample t-test was carried out, which compared the first thirty (A1 = 30) and the last thirty (A2 = 30) respondents as received, which is aligned with the techniques proposed by (Malik et al., 2024; Dióssy et al., 2025). Consistent with (Chavez et al., 2023), the absence of statistically significant differences within the variables among early and late respondents highlighted no response bias, indicating that the data collection procedure in the current research remains reliable and strong. Moreover, the standard method bias was addressed by using Harman’s single-factor test, which unveiled that there was no single factor that accounted for the majority of variance and validated minimal risk. In addition, procedural remedies were also applied, which comprised ensuring the anonymity of the respondents and randomising the order of items to decrease potential bias and improve the validity of the findings.

3.3. Ethical Consideration

The ethical considerations that were upheld in this study were targeted towards the protection, rights, and well-being of all the participants. Participation was informed, and the participants were informed entirely on the aim of the study, the voluntary nature of participation and their right to withdraw anytime and without any consequences, as recommended by (Leopizzi et al., 2021). Besides, consistent with the requirements of (Kazemian et al., 2022), in order to maintain anonymity, no personally identifiable data was gathered, and the answers were coded to eliminate the possibility of tracing the answers to the participants. All the data obtained was stored in secure devices having limited access and could be used in compliance with the data protection laws, and prevent any unauthorised usage. All these ethical considerations guaranteed integrity, transparency, and accountability in the research process.

3.4. Data Analysis

The data analysis was initiated with the data processing, where data cleaning was carried out. Once the data was collected, it was electronically recorded in Microsoft Excel, where it was processed for missing values and outliers. It resulted in the omission of several responses as specified, leaving 380 final responses for the analysis. SmartPLS 4.0 was used to analyse the data and perform PLS-SEM to assess causal relationships and mediation processes that could predict governance that facilitates value alignment across functional domains. The approach supports complicated hierarchical structures, non-normality, and modest sample sizes and delivers stable estimates of direct and indirect effects (Nallaluthan, 2024). Reliability testing was conducted using Cronbach’s alpha and composite reliability (CR), whereby the α and CR values were above the 0.70 threshold of internal consistency as established by the pioneering measurement theory. The convergent validity was determined through the average variance extracted (AVE), and all AVE values were higher than 0.50 as suggested by (Rana et al., 2023), which indicated that constructs accounted for more than half of their items’ variance. The study also used the Heterotrait-Monotrait ratio (HTMT) with the cut-off value of < 0.85 suggested in the study of (Steleżuk & Wolanin, 2023), which is based on contemporary advice instead of traditional standards. Bootstrapping was used to derive confidence intervals of HTMT values, which all indicated statistically significant discriminant validity between latent variables. After confirming the measurement model, the hypotheses were tested by structural path analysis.

The reason why PLS-SEM was used instead of CB-SEM was its high strength to analyse complex models containing many constructs and mediating variables, including strategic governance, family values, and performance outcomes, as emphasised by (Nallaluthan, 2024) as well. In contrast to CB-SEM, PLS-SEM does not presuppose multivariate normality, which is why it can be used in the cases when the data do not meet the normality assumption, which is also typical of research involving family-owned businesses that recommend the utilisation of PLS-SEM reflected by (Gorai et al., 2024) also. Additionally, PLS-SEM also aims at maximising the amount of variance in endogenous constructs, which is also in line with predictive objectives of the study that are suggested by (Maharjan et al., 2024) as well. Since these two techniques require large samples under strict distributional assumptions, the CB-SEM provide biased estimates, but the PLS-SEM provide consistent path coefficients and valid inference despite non-normal and complex data structures.

4. Results and Analysis

4.1. Demographic Analysis

The results related to demographic analysis, shown in Table 1, depict that the sample size of 384 respondents was distributed effectively concerning Gender, Age, Job Roles, Departments, and Industry Experience. The largest group was males (55.73%), with 23.70% not revealing gender. 35-44 was the most predominant (33.33%) age bracket, with 45-54 remaining (28.13%), indicating that the participants were mainly in the mid-age bracket. The number of jobs was relatively equal, and the most represented were supply chain managers (27.08%) and owners (26.30%). Following departmental roles, the marketing respondents headed the participants’ group with 45.57% representation, since the study applied to them. The industry experience was more inclined towards individuals with 6-15 years of experience (46%), suggesting a credible experience-based opinion Table 1.

Table 1. Demographic analysis.

| Demographic Category | Frequency (n) | Percentage (%) | |

| Gender | Male | 175 | 55.73% |

| Female | 118 | 30.73% | |

| Prefer not to say | 91 | 23.70% | |

| Age Range | 25-34 | 70 | 18.23% |

| 35-44 | 128 | 33.33% | |

| 45-54 | 108 | 28.13% | |

| 55+ | 78 | 20.31% | |

| Job Title/Position | Owner | 101 | 26.30% |

| Manager | 80 | 20.83% | |

| Marketing Head | 99 | 25.78% | |

| Supply Chain Manager | 104 | 27.08% | |

| Department | Marketing | 175 | 45.57% |

| Supply Chain | 134 | 34.90% | |

| General Management | 75 | 19.53% | |

| Industry Experience | 1-5 years | 68 | 12.98% |

| 6-10 years | 80 | 25.97% | |

| 11-15 years | 134 | 20.78% | |

| 15+ years | 102 | 18.18% | |

4.2. Multicollinearity (VIF)

The issue of multicollinearity was addressed by observing the Variance Inflation Factor (VIF) values against the threshold of 1-5 to state no or moderate multicollinearity. The results are specified in Table 2.

Table 2. VIF.

| Factor | VIF |

| FV1 | 1.617 |

| FV2 | 2.290 |

| FV3 | 1.869 |

| MP1 | 2.420 |

| MP2 | 3.185 |

| MP3 | 2.330 |

| SCP1 | 2.796 |

| SCP2 | 3.396 |

| SCP3 | 2.616 |

| SG1 | 2.082 |

| SG2 | 2.472 |

| SG3 | 1.923 |

From the values, it can be observed that all VIF values for all the constructs lie between the threshold of 1 and 5, which signifies there is no or moderate multicollinearity.

4.3. Measurement Model – Confirmatory Factor Analysis (CFA)

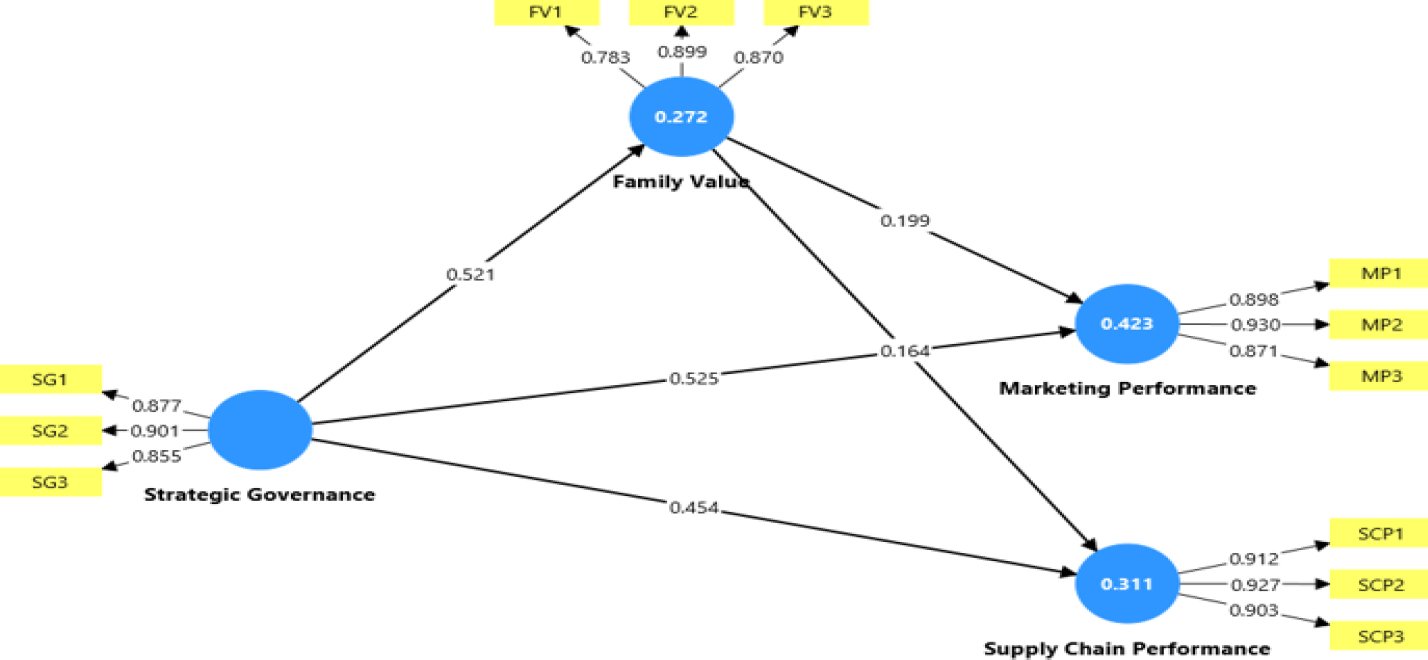

Table 3 indicates the measurement model that was tested with Confirmatory Factor Analysis (CFA), determining the internal consistency of the constructs, reliability of the constructs, and convergent validity by testing Cronbach’s alpha, Composite Reliability (CR), and Average Variance Extracted (AVE).

Table 3. Measurement model using CFA.

| Latent Variables | Indicators | Factor Loadings | Cronbach’s Alpha | Composite Reliability | Average Variance Extracted (AVE) |

| Family Value | FV1 | 0.783 | 0.812 | 0.831 | 0.726 |

| FV2 | 0.899 | ||||

| FV3 | 0.870 | ||||

| Marketing Performance | MP1 | 0.898 | 0.883 | 0.891 | 0.810 |

| MP2 | 0.930 | ||||

| MP3 | 0.871 | ||||

| Supply Chain Performance | SCP1 | 0.912 | 0.851 | 0.852 | 0.771 |

| SCP2 | 0.927 | ||||

| SCP3 | 0.903 | ||||

| Strategic Governance | SG1 | 0.877 | 0.901 | 0.903 | 0.835 |

| SG2 | 0.901 | ||||

| SG3 | 0.855 |

The construct of family values exhibits adequate properties of measurement, where the lowest factor loading is 0.783, and the highest is 0.899. The Cronbach alpha (0.812) and the CR (0.831) are above the required level of 0.7, and the AVE of 0.726 validates strong convergent validity. Marketing performance indicators exhibit higher factor loading (0.871 to 0.930) than the desirable 0.7 level, as is demonstrated in Table 3, despite a high level of CR (0.891), showing strong reliability and AVE (0.810), showing strong convergent validity. Also, factor loadings in the case of the supply chain performance variable range between 0.903 and 0.927, its AVE is 0.771, and its CR is 0.852, which signifies high item-level validity with high construct-level reliability. Strategic governance indicates high item loading (0.855-0.901), whereas alpha and CR are equal to 0.901 and 0.903, which averages 0.835. These results articulate that internal consistency is upheld; however, convergent validity at the level of the indicator is also strong for primary constructs. In Fig. (2), the measurement model of the study is provided.

Fig. (2). Measurement model of the study.

4.4. Discriminant Validity

The HTMT ratio measures the constructs of the study that possess a distinct nature and do not conceptually overlap, as suggested by (Roemer et al., 2021). Table 4 shows the HTMT values of the family value, strategic governance, marketing performance, and supply chain performance constructs. Strategic governance and marketing performance (0.719) and strategic governance and family value (0.620) signify that these are distinct from each other and hold no conceptual overlapping since the values of HTMT are lower than 0.85. Family value holds the lowest HTMT (0.467) with supply chain performance, indicating high distinctiveness.

Table 4. Discriminant validity.

| Family Value | Marketing Performance | Strategic Governance | |

| Marketing Performance | 0.550 | ||

| Strategic Governance | 0.620 | 0.719 | |

| Supply Chain Performance | 0.467 | 0.733 | 0.614 |

4.5. Path Analysis

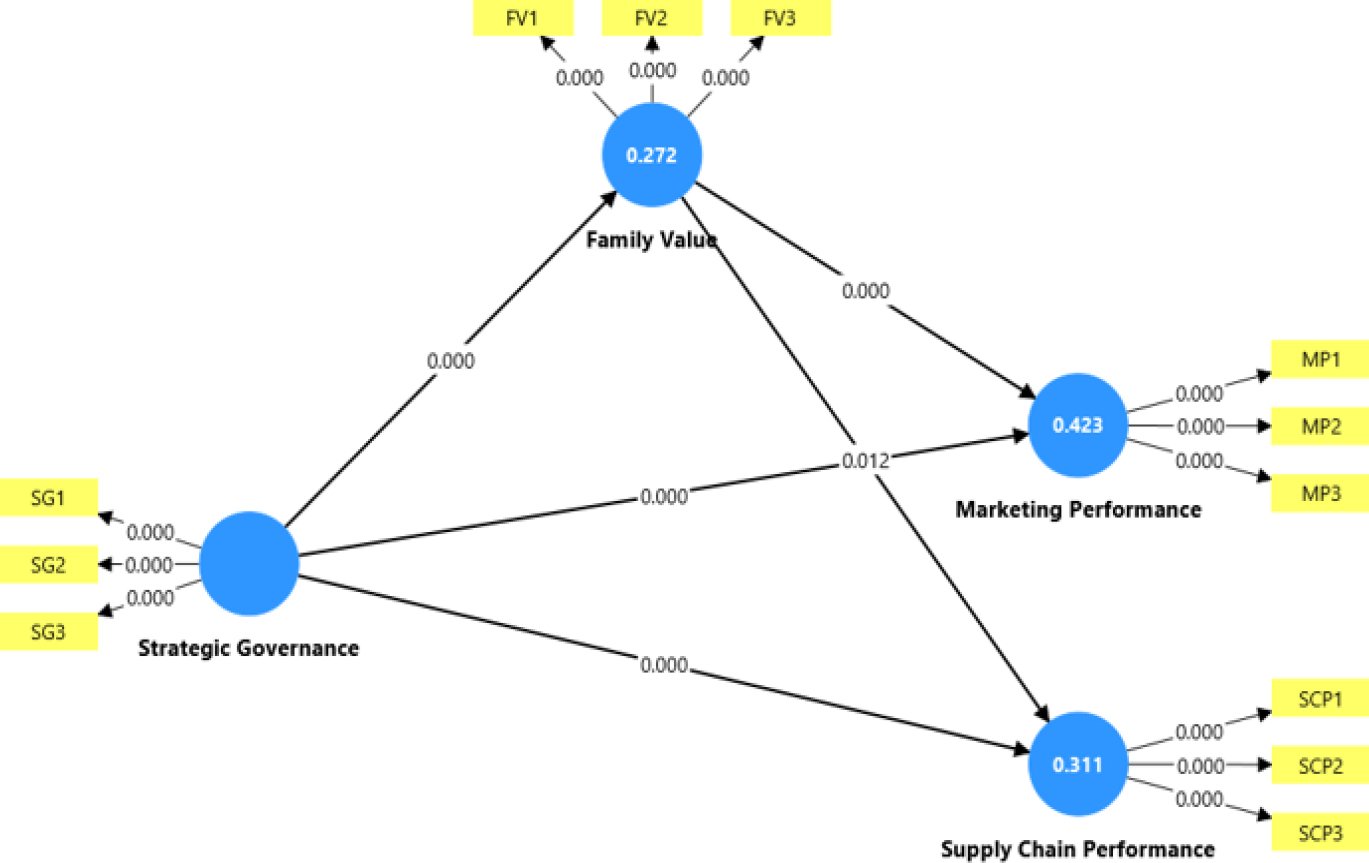

The results of the path analysis Table 5 indicate a number of statistically significant causal relations among the constructs of the study, which are strategic governance, family values, marketing performance, and supply chain performance. The most substantial direct impact is found between Strategic Governance and marketing performance (β = 0.525, P = 0.001) as well as Supply Chain Performance (β = 0.454, P = 0.001), where the effective strategic governance practices have a significant positive impact on marketing and supply chain performance. The outcomes are also consistent with the agency theory that governance is effective in diminishing the opportunistic behaviour and guaranteeing the effective allocation of resources, which is also argued by (Gamble et al., 2021). At the same time, (Carlier et al., 2021) argue that SEW theory presupposes that family firms seek continuity and reputation on a long-term basis, and structured governance is encouraged to protect the firm-specific socioemotional goals. The values of the family that serve as partial mediation might be a cultural aspect of the UK that has formal bureaucracies in governance, but still has the traditional family norms of decision-making. Likewise, Strategic Governance is also a strong predictor of family values (β = 0.521, p = 0.001). This shows that governance practices are imperative in strengthening cultural or value-based mediators in the family-owned business. The result of the Strategic Governance being a strong predictor of family values validates the convergence of governance mechanisms and the socioemotional focus of family-owned enterprises, which is in line with the postulates of SEW theory, as also perceived by (Mariani et al., 2023). As indicated by (Barzegar & Alavi, 2023), institutionalised governance is aligned with family-based goals, that is, continuity, identity, and reputation, and the values become embedded in the process of making decisions. According to an agency theory, this connection suggests that it is possible to balance managerial behaviour with the family interest using formal governance mechanisms and minimise the agency problem. The UK FOBs also have cultural and institutional considerations that contribute to the reinforcement of the level of family values within the governance structures. Moreover, family values have a beneficial and statistically significant effect on marketing performance (β = 0.199, p = 0.001) and Supply Chain Performance (β = 0.164, p = 0.012), which confirms that the existence of strong familial values has a significant contribution to making operations in marketing and logistics functional. The sizes of the coefficients are relatively small, but their significance shows the practical usefulness of cultural embeddedness in strategic decisions.

Table 5. Structural model.

| Direct Effects | Path coefficients | T statistics | P values |

| Family Value -> Marketing Performance | 0.199*** | 3.551 | 0.000 |

| Family Value -> Supply Chain Performance | 0.164*** | 2.508 | 0.012 |

| Strategic Governance -> Family Value | 0.521*** | 12.631 | 0.000 |

| Strategic Governance -> Marketing Performance | 0.525*** | 10.576 | 0.000 |

| Strategic Governance -> Supply Chain Performance | 0.454*** | 8.074 | 0.000 |

| Indirect Effects | Path coefficients | T statistics | P values |

| Strategic Governance -> Family Value -> Marketing Performance | 0.103*** | 3.231 | 0.001 |

| Strategic Governance -> Family Value -> Supply Chain Performance | 0.086** | 2.32 | 0.020 |

Note: ***: Significant at 1%; **: Significant at 5%

Some interesting insights are also delivered by the mediation analysis. Both the indirect associations between Strategic Governance and both Marketing and Supply Chain Performance due to family values are statistically significant; however, they are of moderate strength (β = 0.103, p = 0.001 for marketing; β = 0.086, p = 0.020 for supply chain). In addition, in terms of partial and complete mediation, the results imply that Table 5 indicates partial mediation through family values in the association between strategic governance and both marketing and supply chain performance. The direct impacts of strategic governance on marketing performance (β = 0.525, p = 0.001) and supply chain performance (β = 0.454, p = 0.001) are significant, respectively, as shown in Table 4. Concurrently, the indirect effects through family values are β = 0.103, p = 0.001 for marketing and β = 0.086, p = 0.020 for supply chain and are also statistically significant.

The results confirm that family values are a mediator between strategic governance and marketing performance, as well as supply chain performance. In theoretical terms, this can be attributed to the socioemotional wealth (SEW) theory, as revealed by (Debellis et al., 2024), family-related priorities, such as legacy, reputation, and emotional attachment, affect the process of governance mechanism implementation in family-owned businesses. At the same time, the agency theory defines the direct impact of the governance that is relatively strong, and formal organisation minimises the agency problem and makes the managerial behaviour consistent with the goals of the firm (Anatasia et al., 2023). According to the partial mediation, family values not only affect governance impact but also cultural and institutional aspects in the UK FOBs, including regulatory compliance and traditional family norms, which mediate the extent to which the same values affect better operational performance. In Fig. (3), the measurement model with path coefficients, T-statistics, and R-squared values is provided.

Fig. (3). Measurement model with path coefficients, T-statistics, and R-squared values.

4.6. Predictive Quality

The value of R-squared Table 6 signifies that 27.2% of the variation in family values is explained by strategic governance. Also, strategic governance explains 42.3% of % variation in market performance and 31.1% of the variation in supply chain performance.

Table 6. R-square.

| R-Square | |

| Family Value | 0.272 |

| Marketing Performance | 0.423 |

| Supply Chain Performance | 0.311 |

4.7. Model Fit Indices

The model fit indices show acceptable adequacy of the structural model. As depicted in Table 7, the values of SRMR for both saturated 0.056) and estimated models (0.099) lie within the threshold of (<0.10), which signifies restricted discrepancy between the predicted and observed correlations. Likewise, the values of NFI (0.850 and 0.824) surpass he least suggested benchmark of 0.80, which also depicts adequate model fitness.

Table 7. Model fit.

| Saturated Model | Estimated Model | |

| SRMR | 0.056 | 0.099 |

| NFI | 0.850 | 0.824 |

4.8. Effect Size

The f2 values indicate effect sizes in terms of the strength of cause-and-effect relationships in the model. As depicted in Table 8, the highest effects are observed with Strategic Governance with (f2 = 0.373) when applied to family values and (f2 = 0.348) when applied to marketing performance, which are both medium effect sizes. This implies that the systems of governance play key roles in value creation and market performance in UK FOBs. Its impact on supply chain performance (f2 = 0.218) is more minor, which implies that governance also led to the improvement of operations together with other contextual variables. Family values have relatively low influence on marketing performance (f2 = 0.050) and on supply chain performance (f2 = 0.029), which is small.

Table 8. Effect size.

| f-Square | |

| Family Value -> Marketing Performance | 0.050 |

| Family Value -> Supply Chain Performance | 0.029 |

| Strategic Governance -> Family Value | 0.373 |

| Strategic Governance -> Marketing Performance | 0.348 |

| Strategic Governance -> Supply Chain Performance | 0.218 |

4.9. Discussion and Hypotheses Assessment

This study was an attempt to examine the relationship between strategic governance, supply chain performance, and marketing performance under the mediating effect of family values in the context of FOBs operating in the UK. Three hypotheses have been tested, and the findings are discussed systematically.

4.9.1. Strategic Governance and Marketing Performance

In the first hypothesis (H1), a positive and significant connection between strategic governance mechanisms and marketing performance in the context of FOBs in the UK was observed. Since the findings have shown, the path coefficient ( = 0.525, = 0.001) shows a significant influence, which means that the well-organised decision-making, accountability of the boards, and clear strategic processes can have a significant effect on the improvement of the market-related outcomes in FOBs. This finding aligns with a study by (Kazemian et al., 2022), which found that effective governance structures lead to improved market orientation in Australian FOBs. The reason behind similar findings is that strategic governance, when oriented towards customers, leads to continuous quality improvements in products and services, which improves brand reputation; as a result, the market performance of the brand is enhanced. Several cultural differences also contribute to these findings; for instance, the UK’s corporate governance and regulatory compliance culture provides an effective basis for influencing FOBs to adopt formal structures that facilitate greater accountability and clarity in strategic direction.

Second, the British professionalism and business-personal life culture enhances transparency in making decisions of any family business, as suggested by (Mariani et al., 2023). In addition to that, the positive, significant correlation between the strategic governance and the marketing performance provides a valuable contribution to the theoretical context revealing that in the UK FOBs, as (Khan et al., 2022) argues that the functions of the governance are not just the mechanisms of control as envisaged by the agency theory but also the strategic facilitator influenced by the family-based priorities. This is an extension of SEW theory, implying that long-term orientation and family identity issues reinforce, rather than inhibit, the success of governance practices in terms of market outcomes (Kazemian et al., 2022). Therefore, the research contributes to the debate by demonstrating how family influence can be employed as governance capital, making markets more responsive rather than functioning as a form of cultural inertia.

Such cultural dimensions are different in Australia, whereby the relationships between family members dictate governance, and this is why the UK FOBs are observed to coordinate governance behaviour and market performance effectively, unlike those that perceive their business cultures as less formal and relationship-oriented. The results also support SEW theory that is based on the premise that family firms give priority to non-financial outcomes including legacy, image, reputation and emotional attachment with customers and tend to combine these priorities within governance systems and strategic decisions as mentioned in the research conducted by (Kazemian et al., 2022). The alignment also comes through the UK governance and regulatory culture, which incorporates transparency and accountability in formal structures thus enhancing the family seeking socioemotional outcomes. When strategic governance mechanisms are designed to safeguard and add value to SEW, sustainable quality improvement, client confidence, and subsequently, enhanced brand reputation and market performance become sustainable advantages to FOBs.

4.9.2. Strategic Governance and Supply Chain Performance

The other (H2) hypothesis that tested the impact of strategic governance on the performance of supply chains was also supported (= 0.454, p = 0.001). The current study can be generalised to the family-owned businesses (FOBs) in the UK and indicate that a strategic governance process can become a significant facilitator of the supply chain performance by allowing a long-term control and alignment as well as the risk management (Nagalingam et al., 2022; Li et al., 2025). The two articles highlight the contribution of the element of governance as an opportune predictor of supply chain efficacy and openness. However, one of the main differences lies in digital integration. Chinese companies have become leaders in incorporating digital tools into governance frameworks and enhancing responsiveness in their logistics systems and inventory management. In contrast, UK FOBs continue to operate on legacy systems that carry a considerable debt to traditional family principles.

The agency theory also supports these findings by assuming that the efficient governance structure should help FOBs to reduce the inefficiencies by aligning the actions of managers with the interests of suppliers to sustain the principle-agent relationship, which is also supported by (Mariani et al., 2023). Governance enhances the performance of the supply chain in the context of UK FOBs through oversight and risk management although reliance on legal supply chain systems still exists. Contrary to the Chinese companies that have high-level digital supply chain operations, UK FOBs combine traditional family values in all governance systems where the agency theory displays how formal mechanisms decrease the opportunities and maintain the reliability of the supply chain. The positive correlation in the supply chain of governance supplements the agency theory, as the hierarchy of oversight and the enhancement of decision rights help minimise coordination inefficiencies in UK FOBs (Ghinizzini et al., 2025). The current study, however, contributes to the body of knowledge by demonstrating that a family-based strategic horizon aligned with SEW priorities enhances the effectiveness of supply chain governance, as also noted by (Gamble et al., 2021). Instead of limiting decision-making in operations, family identity and continuity issues strengthen long-term orientation and stability. This presents a new insight that in FOBs, family influence does not dilute the governance process, which is a stabilising factor, risk management, and encourages joint practises in the supply chain even in the digitally changing environment as confirmed by (Debellis et al., 2024).

Such dependence on informal, non-digitised mechanisms of governance can limit the extent to which the advantages of the supply chain can be maximised. Consequently, the performance gap appears to be driven by technological disparities, highlighting the potential of digital governance to advance supply chain effectiveness in family business contexts. Further, UK culture, which emphasises punctuality and reliability, enhances self-discipline when selecting and managing supply chains, thereby advising FOBs to develop a governance framework that facilitates timely operations (Lyon et al., 2025). Second, the UK prefers the formal nature of contracts and supplier relationships to cultures that value informal networks, which promote sound monitoring and coordination (Kyere & Ausloos, 2021). Such cultural norms play a role in improving the success of strategic governance aimed at enhancing performance across supply chains within UK FOBs, compared to China, where relational forces tend to exert more potent effects on supply chain management efforts.

4.9.3. Mediating Effect of Family Values

The third hypothesis (H3) determined whether family values mediated the connection between strategic governance and the two performance indicators. Indirect effects on marketing performance (β = 0.103, p = 0.001) and supply chain performance (β = 0.086, p = 0.020) were significant, and partial mediation was observed. This shows that strategic governance is not only directly effective, but the relationship is further elevated when governance aligns with core family values. Similar findings were reported by (Debellis et al., 2024), who found that family values can serve as a legacy that is transformed into strategic governance of FOBs, thereby improving firms’ market performance. Potential cultural determinants of these results include the cultural esteem for heritage and continuity in the UK, which favours integrating family and its values into the structural groupings of governance, enabling FOBs to employ the legacy as a strategic resource (Lyon et al., 2025).

Furthermore, the British tendency to reconcile the traditional and modern approaches to business makes it beneficial to inculcate primary family values and organised governance to improve both the marketing and the supply chain performance. These cultural factors set the UK FOBs apart from countries like China, where family influence can be at odds with formal governance, underscoring how legacy can serve as a source of competitive advantage in the case of strategic appreciation. The mediation findings build on SEW theory by demonstrating that family values constitute strategic governance capital and therefore add value rather than hinder performance outcomes. The partial mediation suggests that although governance structures independently enhance marketing and supply chain performance, these processes become particularly beneficial for coordinating the priorities of identity, continuity, and emotional attachment, as supported by (Leopizzi et al., 2021) as well. This supports the findings of (Ghinizzini et al., 2025), who also showed that family values in UK FOBs are not merely cultural artefacts but performance-sensitive resources that shape the implementation of governance decisions. Accordingly, the current study has made a subtle contribution to knowledge: SEW-compliant governance enhances greater strategic consistency and functional dedication.

CONCLUSION

This study concludes that strategic governance plays a central role in improving both marketing performance and the supply chain in family-owned businesses (FOBs) in the UK. The results show that sound governance systems, as practical leadership approaches, accountability systems, and formalised decision-making processes, are some of the major contributors towards enhancing functional results in significant business areas. When such governance mechanisms are strategically developed and deployed in the UK FOBs, the result is effective coordination, timely responses to market dynamics, and operational efficiency, leading to improved performance in marketing and supply chains. One significant observation from the study is the role of the values instilled in families in mediating these results. Contrary to posing competition to formal strategic governance, the family value of trust, loyalty, and long-term orientation manifests itself as a complement to and enhances the strategic governance-performance alliance. This indicates that the diverse cultural background could be a strategic asset for UK-based FOBs when matched with modern administrative and governance policies.

LIMITATIONS OF THE STUDY AND FUTURE DIRECTIONS

The current study has several limitations, such as its focus on FOBs in the UK, which limits the generalisability of the results to other forms of business and regions. The cross-sectional design also prevents inference about a long-term cause-and-effect relationship among variables, and reliance on self-reported data can lead to response bias. In addition, variables such as family values are subjective and tend to vary across respondents. Therefore, in terms of future directions, studies should include comparative analysis across different business types, sectors, and regions with different governance systems. In addition, technological variables such as digital transformation or strategic governance driven by AI tools could provide in-depth insights into developing supply chain and marketing dynamics across FOBs. This will further advance the strategic governance literature across different organisational contexts. Lastly, future studies should adopt a longitudinal research design to strengthen causal conclusions regarding governance, family values, and performance. Time-tracking of FOBs would help understand the evolution of governance reforms, changes in family values across generations, and how mediation effects increase or decrease as market or institutional conditions change.

POLICY IMPLICATIONS

The results provide practical policy implications closely related to the realised governance-performance relationships. As strategic governance substantially forecasts the performance of marketing and supply chains, regulators must advise UK family firms to institutionalise strategic review processes and open decision-making frameworks, as these can contribute to significant performance gains. Government agencies and professional organisations could introduce governance certification schemes or specific grants to facilitate the implementation of organised planning, director responsible governance, and information-based governance. The fact that governance has a significant positive impact on family values also underscores the need for advisory programmes that help firms convert socioemotional priorities, such as continuity and identity, into strategic routines. Considering the identified partial mediation, the policy should, when used, encourage tools such as family constitutions, value-alignment workshops, and succession protocols to entrench the reforms within family governance processes and norms. Combined with the implications, family values may serve as governance-enhancing capital, strengthening strategic performance without weakening in UK FOB.

AUTHOR’S CONTRIBUTION

S.A. has contributed to conceptualization, idea generation, problem statement, methodology, results analysis, results interpretation.

ETHICS APPROVAL AND CONSENT TO PARTICIPATE

Not applicable.

HUMAN AND ANIMAL RIGHTS

No Animals/Humans were used for studies that are the basis of this research.

AVAILABILITY OF DATA AND MATERIAL

The data will be made available on reasonable request by contacting the corresponding author [S.A.].

FUNDING

None.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest regarding the publication of this article.

ACKNOWLEDGEMENTS

Declared None.

APPENDIX A-QUESTIONNAIRE

| Question | Response Options |

| Age | ☐ 25–34 ☐ 35–44 ☐ 45–54 ☐ 55+ |

| Gender | ☐ Male ☐ Female ☐ Prefer not to say |

| Job Position | ☐ Owner ☐ Manager ☐ Marketing Head ☐ SCM Head |

| Department | ☐ Marketing ☐ Supply Chain ☐ General Management |

| Years of Experience in the Industry | ☐ 1–5 years ☐ 6–10 years ☐ 11–15 years ☐ 15+ years |

| Variable | Items | 1 | 2 | 3 | 4 | 5 |

| Strategic Governance (IV) | Our business has formal governance mechanisms (e.g., board meetings, policies). | ☐ | ☐ | ☐ | ☐ | ☐ |

| Strategic decisions in our company are made through a transparent process. | ☐ | ☐ | ☐ | ☐ | ☐ | |

| We regularly review and align our business strategies with long-term goals. | ☐ | ☐ | ☐ | ☐ | ☐ | |

| Family Values (Mediator) | Family traditions and legacy significantly influence our business decisions. | ☐ | ☐ | ☐ | ☐ | ☐ |

| We prioritise long-term stability over short-term profits due to family values. | ☐ | ☐ | ☐ | ☐ | ☐ | |

| There is a strong sense of emotional attachment between the family and business. | ☐ | ☐ | ☐ | ☐ | ☐ | |

| Marketing Performance (DV) | Our marketing strategies have helped improve customer loyalty. | ☐ | ☐ | ☐ | ☐ | ☐ |

| We effectively adapt to changes in customer preferences and digital trends. | ☐ | ☐ | ☐ | ☐ | ☐ | |

| Our brand reputation has improved in recent years due to strategic initiatives. | ☐ | ☐ | ☐ | ☐ | ☐ | |

| Supply Chain Performance (DV) | Our supply chain is highly responsive to changes in demand or disruptions. | ☐ | ☐ | ☐ | ☐ | ☐ |

| We have improved cost-efficiency in our supply chain over the past 2 years. | ☐ | ☐ | ☐ | ☐ | ☐ | |

| Our supply chain operations reflect strategic alignment with our governance. | ☐ | ☐ | ☐ | ☐ | ☐ |

REFERENCES

Ahmad S. (2025). The role of family governance, identity and social capital in the transgenerational sustainability of family SMEs. Journal of Asia Business Studies,19 (2), 388–407. https://doi.org/10.1108/JABS-10-2023-0456.

Anatasia, V., Arafah, W., & Usman, B. (2023). The Influence of Strategic Orientation on Family Business Survival Mediated by Innovation in Service Industry. Dinasti International Journal of Management Science (DIJMS), 5(2). DOI: https://doi.org/10.31933/dijms.v5i2.2116.

Barzegar, M., & Alavi, S. M. (2023). Investigating the Impact of Corporate Governance and Company Strategy on the Performance of Family-Owned Companies. Empirical Research in Accounting, 13(4), 111-142. https://jera.alzahra.ac.ir/jufile?ar_sfile=214190andlang=en.

Carlier, S., Coppens, D., De Backere, F., & De Turck, F. (2021). Investigating the influence of personalised gamification on mobile survey user experience. Sustainability, 13(18), 10434. https://doi.org/10.3390/su131810434.

CEBR (2025). The Economic Impact of Family-Owned Businesses 2025 CEBR. Retrieved from https://cebr.com/reports/economic-impact-of-family-owned-businesses/.

Chavez, R., Malik, M., Ghaderi, H., & Yu, W. (2023). Environmental collaboration with suppliers and cost performance: Exploring the contingency role of digital orientation from a circular economy perspective. International Journal of Operations & Production Management, 43(4), 651-675. https://doi.org/10.1108/IJOPM-01-2022-0072.

Debellis, F., Rondi, E., Buckley, P. J., & De Massis, A. (2024). Family firms and the governance of global value chains. Journal of International Business Studies, 55(8), 962-975. https://doi.org/10.1057/s41267-024-00716-4.

Dióssy, K., Losonci, D., Aranyossy, M., & Demeter, K. (2025). The role of leadership in digital transformation–a paradox way to improve operational performance. Journal of Manufacturing Technology Management, 36(9), 88-113. https://doi.org/10.1108/JMTM-07-2024-0386.

FBU (2025). Britain’s Largest Family Firms. Family Bus United. Retrieved from https://www.familybusinessunited.com/britainslargestfamilyfirms.

Gamble, J. R., Clinton, E., & Díaz-Moriana, V. (2021). Broadening the business model construct: Exploring how family-owned SMEs co-create value with external stakeholders. Journal of Business Research, 130, 646-657. https://doi.org/10.1016/j.jbusres.2020.03.034.

Ghinizzini, V., Benfante, C., Magri, C., & Gabrielli, G. (2025). Does the governance of Italian-listed family firms impact the reporting of social aspects?. Social Responsibility Journal. https://doi.org/10.1108/SRJ-03-2025-0285.

Gorai, J., Kumar, A., and Angadi, G. R. (2024). Smart PLS-SEM modeling: Developing an administrators’ perception and attitude scale for apprenticeship programme. Multidisciplinary Science Journal, 6(12), 2024260-2024260. https://doi.org/10.31893/multiscience.2024260.

Harjito, D. A., Santoso, A. R. C., & McGowan Jr, C. B. (2021). The effect of corporate governance and corporate strategy on family firm performance in Indonesia. Journal of Applied Business Research, 37(1). https://doi.org/10.2991/aebmr.k.200127.082.

Huseyin, E. (2023). Financial Performance Metrics in Family vs Non-Family CEOs of Family-Owned Firms. Journal of Policy Options, 6(2), 1-8. https://resdojournals.com/index.php/jpo/article/view/310.

Jum’a, L., Zimon, D., & Ikram, M. (2021). A relationship between supply chain practices, environmental sustainability and financial performance: evidence from manufacturing companies in Jordan. Sustainability, 13(4), 2152. https://doi.org/10.3390/su13042152.

Kazemian, S., Djajadikerta, H. G., Trireksani, T., Mohd-Sanusi, Z., & Alam, M. M. (2022). Corporate governance and business performance of hotels in Western Australia: analysis of market orientation as a mediator. Business Process Management Journal, 28(3), 585-605. https://doi.org/10.1108/BPMJ-05-2021-0335.

Khan, R. U., Salamzadeh, Y., Abbasi, M. A., Amin, A., & Sahar, N. E. (2022). Strategic orientation and sustainable competitive performance of family firms: Evidence of an emerging economy. Journal of Small Business Strategy, 32(2), 67-82. https://doi.org/10.53703/001c.32406.

Klumpp, M. (2018). How to achieve supply chain sustainability efficiently? Taming the triple bottom line split business cycle. Sustainability, 10(2), 397. https://doi.org/10.3390/su10020397.

Kyere, M., & Ausloos, M. (2021). Corporate governance and firms financial performance in the United Kingdom. International Journal of Finance & Economics, 26(2), 1871-1885. https://doi.org/10.1002/ijfe.1883.

Lee, S., Park, S. J., & Seshadri, S. (2023). Variations of the bullwhip effect across foreign subsidiaries. Manufacturing and Service Operations Management, 25(1), 1-18. https://doi.org/10.1287/msom.2022.1137.

Leopizzi, R., Pizzi, S., & D’Addario, F. (2021). The relationship among family business, corporate governance, and firm performance: an empirical assessment in the tourism sector. Administrative Sciences, 11(1), 8. https://doi.org/10.3390/admsci11010008.

Li, A., Ma, K., & Jin, S. (2025). Digitization and Internal Governance: The Power to Drive the Impact of Supply Chain Efficiency on Corporate Sustainability. Sustainability, 17(12), 5583. https://doi.org/10.3390/su17125583.

Liu, L., Song, W., & Liu, Y. (2023). Leveraging digital capabilities toward a circular economy: Reinforcing sustainable supply chain management with Industry 4.0 technologies. Computers & Industrial Engineering, 178, 109113. https://doi.org/10.1016/j.cie.2023.109113.

Lyon, F., Stubbs, W., Dahlmann, F., & Edwards, M. (2025). From “business as usual” to sustainable “purpose‐driven business”: Challenges facing the purpose ecosystem in the United Kingdom and Australia. Business and Society Review, 130, 198-221. https://doi.org/10.1111/basr.12341.

Malik, M., Andargoli, A., Clavijo, R. C., & Mikalef, P. (2024). A relational view of how social capital contributes to effective digital transformation outcomes. The Journal of Strategic Information Systems, 33(2), 101837. https://doi.org/10.1108/IJOPM-01-2022-0072.

Mariani, M. M., Al-Sultan, K., & De Massis, A. (2023). Corporate social responsibility in family firms: A systematic literature review. Journal of Small Business Management, 61(3), 1192-1246. https://doi.org/10.1080/00472778.2021.1955122.

Maharjan, R., Danuwar, R. K., Kayestha, M., Dhakal, A., Baral, D. K., Rajopadhyaya, A., … and Timalsina, D. P. (2024). Measuring the Effects of Entrepreneurial Orientation on Social Media Adoption and SME’s Performance in Kathmandu Valley: Evidence from Structural Equation Modeling Using Smart PLS 4.0. Economic Journal of Development Issues, 37(1), 27-47. DOI: https://doi.org/10.3126/ejdi.v37i1.63914.

Nagalingam, N., Kumarapperuma, C., Malinga, C., Gayanthika, K., Amanda, N., & Perera, A. (2022). Corporate governance and firm integrated performance: A conceptual framework. http://rda.sliit.lk/handle/123456789/2768.

Nallaluthan, K., Kamaruddin, S., Thurasamy, R., Ghouri, A. M., & Kanapathy, K. (2024). Quantitative data analysis using PLS-SEM (SmartPLS): Issues and challenges in ethical consideration. International Business Education Journal, 17(2), 41-54. https://doi.org/10.37134/ibej.Vol17.2.4.2024.

Oluwatukesi, S. O., Balogun, L. A., Oluwatukesi, T. E., & Jaiyesimi, B. G. (2023). Entrepreneurial orientation and customer satisfaction of family-owned business in Lagos state, Nigeria. https://doi.org/10.52589/BJMMS-KPD4SNEA.

Patrick, O. A., Chike, N. K., & Onyekwelu, P. N. (2022). Succession planning and competitive advantage of family-owned businesses in Anambra State. Cross Curr Int J Econ Manag Media Stud, 4(3), 28-33. https://doi.org/10.36344/ccijemms.2022.v04i03.003.

Qi, J., & Mohammad, M. (2024). Corporate Governance in Family-Owned Businesses: Balancing Tradition and Innovation for Long-term Growth in China. Uniglobal Journal of Social Sciences and Humanities, 3(2), 401-407. https://doi.org/10.53797/ujssh.v3i2.43.2024.

Rana, J., Gutierrez, P. L., & Oldroyd, J. C. (2023). Quantitative methods. In Global encyclopedia of public administration, public policy, and governance (pp. 11202-11207). Cham: Springer International Publishing. https://doi.org/10.1007/978-3-030-66252-3_460.

Randerson, K., & Radu-Lefebvre, M. (2021). Managing ambivalent emotions in family businesses: governance mechanisms for the family, business, and ownership systems. Entrepreneurship Research Journal, 11(3), 159-176. https://doi.org/10.1515/erj-2020-0274.

Roemer, E., Schuberth, F., & Henseler, J. (2021). HTMT2–an improved criterion for assessing discriminant validity in structural equation modeling. Industrial management and data systems, 121(12), 2637-2650. https://www.emerald.com/insight/content/doi/10.1108/imds-02-2021-0082/full/html.

Sadiq, M., & Gebba, T. R. A. (2022). Financial performance, firm value, transparency and corporate governance. Evidences from family-owned business in UAE. Transnational Corporations Review, 14(3), 286-296. https://doi.org/10.1080/19186444.2021.1938496.

Sánchez-Marín, G., Lozano-Reina, G. & Beglaryan, M., (2024). Linkages between high-performance work practices and family-centered goals: Implications for financial performance in family firms. Journal of Small Business and Enterprise Development, 31(1), 126-151. https://doi.org/10.1108/JSBED-03-2023-0117.

Salem, L. A. E. M., & Hashem, A. E. (2023). Socioemotional Wealth in Family Firms: Theoretical Dimensions, Socioemotional Wealth Perspective, and Empirical Evidence in Support of the Socioemotional Approach. The Academic Journal of Contemporary Commercial Research, 3(3), 1-20. https://doi.org/10.21608/ajccr.2023.318181.

Schweiger, N., Matzler, K., Hautz, J., & de Massis, A. (2024). Family businesses and strategic change: the role of family ownership. Review of Managerial Science, 18(10), 2981-3005. https://doi.org/10.1007/s11846-023-00703-3.

Sorenson, R. L., & Milbrandt, J. M. (2023). Family social capital in family business: A faith-based values theory. Journal of Business Ethics, 184(3), 701-724. https://doi.org/10.1007/s10551-022-05110-4.

Steleżuk, A., & Wolanin, M. (2023). Primary research using quantitative methods in social sciences. Zeszyty Naukowe Wyższej Szkoły Technicznej w Katowicach, 16. http://www.wydawnictwo.wst.pl/uploads/files/79b35e4908c67f4d2e795555bf4f63fe.pdf.

Temprano-García, V., Pérez-Fernández, H., Rodríguez-Pinto, J., Rodríguez-Escudero, A. I., & Barros-Contreras, I. (2023).23 How to build a brand-oriented family firm: The impact of socioemotional wealth (SEW) dimensions. Journal of Business Research, 163, 113929. https://doi.org/10.1016/j.jbusres.2023.113929.

Thomas, F. B. (2022). The role of the purposive sampling technique as a tool for informal choices in a social Sciences in research methods. Just Agriculture, 2(5), 1-8. https://justagriculture.in/files/newsletter/2022/january/47.%20The%20Role%20of%20Purposive%20Sampling%20Technique%20as%20a%20Tool%20for%20Informal%20Choices%20in%20a%20Social%20Sciences%20in%20Research%20Methods.pdf.

Wasdani, K. P., Vijaygopal, A., Manimala, M. J., & Verghese, A. K. (2021). Impact of corporate governance on organisational performance of Indian firms. Indian Journal of Corporate Governance, 14(2), 180-208. https://doi.org/10.1177/09746862211047396.

Xian, H., Jiang, N., & McAdam, M. (2021). Negotiating the female successor–leader role within family business succession in China. International Small Business Journal, 39(2), 157-183. https://doi.org/10.1177/0266242620960711.

Zapata-Cantu, L., Sanguino, R., Barroso, A., & Nicola-Gavrilă, L. (2023). Family business adapting a new digital-based economy: Opportunities and challenges for future research. Journal of the Knowledge Economy, 14(1), 408-425. https://doi.org/10.1007/s13132-021-00871-1.

Licensed

© 2025 Copyright by the Authors.

Licensed as an open access article using a CC BY 4.0 license.

Article Contents Author Yazeed Alsuhaibany1, * 1College of Business-Al Khobar, Al Yamamah University, Saudi Arabia Article History: Received: 03 September,

Article Contents Author Muhammad Arslan Sarwar1, * Maria Malik2 1Department of Management Sciences, University of Gujrat, Gujrat, Pakistan; 2COMSATS

Article Contents Author Tarig Eltayeb1, * 1College of Business Administration, Imam Abdulrahman Bin Faisal University, Dammam, Saudi Arabia Article History:

Article Contents Author Kuon Keong Lock1, * and Razali Yaakob1 1Faculty of Computer Science and Information Technology, Universiti Putra Malaysia,

Article Contents Author Shabir Ahmad1, * 1College of Business, Al Yamamah University, Al Khobar, Kingdom of Saudi Arabia Article History:

Article Contents Author Ghanima Amin1, Simran1, * 1Department of Biological Sciences, University of Sialkot, Sialkot 51310, Pakistan Article History: Received:

PDF

PDF