Article Contents

Role of Hybrid Models of Defi and Traditional Banking Systems in Improving the Profitability of European Banks: An Analysis of the Future Possibilities

⬇ Downloads: 38

Cite

Alotaibi, A. A. (2025). Role of hybrid models of DeFi and traditional banking systems in improving the profitability of European banks: An analysis of the future possibilities. Advances Journal of Business Management and Social Sciences, 1(1), 1–12. https://doi.org/10.65080/nvdx4984

Alotaibi, Abdullah Awadh. 2025. “Role of Hybrid Models of DeFi and Traditional Banking Systems in Improving the Profitability of European Banks: An Analysis of the Future Possibilities.” Advances Journal of Business Management and Social Sciences 1 (1): 1–12. https://doi.org/10.65080/nvdx4984

Alotaibi, A.A., 2025. Role of hybrid models of DeFi and traditional banking systems in improving the profitability of European banks: An analysis of the future possibilities. Advances Journal of Business Management and Social Sciences, 1(1), pp.1–12. Available at: https://doi.org/10.65080/nvdx4984

Alotaibi AA. Role of hybrid models of DeFi and traditional banking systems in improving the profitability of European banks: An analysis of the future possibilities. Adv J Bus Manag Soci Sci. 2025 Feb 7;1(1):1–12. doi:10.65080/nvdx4984.

1Department of Business Administration, Imam Abdulrahman Bin Faisal University, Dammam, Saudi Arabia

Received: 16 October, 2024

Accepted: 12 January, 2025

Revised: 27 December, 2024

Published: 07 February, 2025

Abstract:

Aims & Objectives: This study examined the influences of Decentralised finance (DeFi), digitalisation, Fintech, the regulatory scenario, efficiency, and risk and safety management on the performance of European banks.

Methods: The data was obtained using a structured questionnaire survey on five-point Likert Scale from 381 professionals, banking executives, and Fintech specialists across different European countries namely Germany, France, the Netherland, Sweden and Estonia. In this study, the profitability of European banks is the dependent Variable. In contrast, independent Variables are DeFi adoption, digitalization and fintech adoption, regulatory environment, operational efficiency, and risk management. The data was analysed using the Partial Least Square-Structural Equation Modelling (PLS-SEM) through SmartPLS.

Results: It has revealed that digitisation and Fintech adoption (B= -0.020, P-value= 0.650) has a negative and insignificant impact on bank performance. Integration of DeFi solution (B= 0.083, P-value= 0.025), Operational efficiency (B= 0.103, P-value= 0.035) and Risk and safety measures (B= 0.749, P-value= 0.000) have positive and significant impact on bank performance. Furthermore, regulatory environment (B= 0.021, P-value= 0.674) are indicated to have insignificant and positive impact on bank performance.

Conclusion: These results, therefore, call for a combination of technology management with legal requirements to improve the performance of banking institutions.

Keywords: Decentralised finance (DeFi), digitalization, fintech adoption, regulatory environment, operational efficiency, traditional banking system.

1. Introduction

Decentralised finance (DeFi) is an innovative financial model where blocks perform all functions instead of a specific central figure being absent (Anoop & Goldston, 2022). The European banking industry has adopted conventional financial business structures and conservative risk-taking. Bank stability became an issue of paramount importance after the 2008 financial crisis and the subsequent severe recession. This period of crisis before the full onset of the credit crunch instigated by the subprime crisis of 2007 ensnared global financial markets and made the question of financial stability in financial institutions relevant again (Ben Jabra et al., 2017; Gogol et al., 2024). Over the years, there has been increasing pressure for change instigated by fintech, digitalization, and DeFi. Digitalization remains one of the most significant disruptors affecting the financial stability since the effects of digital transformation have been immensely felt in financial services in enabling business efficiency (Sadati et al., 2024; Thottoli et al., 2023). DeFi is based on blockchain and is more transparent, secure, and efficient than classical banking, including lending, borrowing, and asset management. While centralized finance, or CeFi, bases itself on intermediaries, trust, and governance, DeFi uses smart contracts and decentralised applications to perform P2P transactions (Ferreira, 2024). This approach supplements the initial costs, increases work productivity, and allows users to share resources conveniently. Additionally, DeFi reduces reliance on intermediaries and optimizes efficiency by automating DeFi’s functions and customizing its responses: it gives several reasons why DeFi should be implemented (Auer et al., 2024).

CeFi is based on trust, regulation, and the identification of users, whereas DeFi is based on technology, code, and consensus among participants. While DeFi has high-potential prospects for innovation, transparency, and financial inclusion, there are also issues surrounding integration, regulation, and system stability. Integrating DeFi into the overall financial system successfully calls for coordination among financial institutions, regulators, and technology developers (Xu et al., 2024). A multi-stakeholder strategy, combining long-standing institutions, policymakers, and DeFi pioneers, is central to making DeFi a true catalyst for economic growth and collective advancement (Uzougbo et al., 2024).

Notwithstanding the growing body of research on DeFi, there is still scarce knowledge regarding how DeFi can be efficiently and profitability embedded in current banking systems, particularly in Europe. Although there are some scholars such as (Momtaz, 2024; and Schuler et al., 2024) who investigate DeFi–CeFi convergence, and (Ali, 2024; and Asl & Jabeur, 2024) who propose operational efficiency through DeFi uptake, there is little empirical research targeted at European banks to investigate its impact on bank performance. This research fills that gap by investigating how the incorporation of DeFi technologies can improve income streams, operating efficiency, and the resilience of European financial institutions.

The European context is particularly important to study the integration of DeFi into traditional banking due to its unique combination of regulatory maturity, technological advancement, and market diversity. Europe has established harmonised digital financial framework through regulations such as PSD2 and MiCA , promoting innovation while safeguarding financial stability and consumer protection (Momtaz, 2024). It creates a conducive environment to test how DeFi can complement conventional banking without compromising regulatory compliance. Furthermore, European banks are more conservative with deeply entrenched legal systems, making the region an ideal testing ground for transformative potential of DeFi (Schuler et al., 2024). The region also features diverse financial institutions from global banks to regional cooperatives providing rich comparative data to assess DeFi’s impact. Furthermore, proactive approach of Europe towards digital transformation, financial inclusion and cross-border standardisation makes it a model region to examine how DeFi can drive sustainable innovation in a tightly regulated financial system.

As European banks face accelerated digital transformation, changing regulations, and rising competition, findings from this research will be useful to institutions, regulators, and fintech players. Europe’s advanced regulatory environment and harmonised digital marketplace (e.g., PSD2, MiCA) provide the perfect context to study the effective integration of DeFi into conventional banking models, complementing innovation while controlling financial risk. These regulatory advancements not only support innovation but also ensure robust consumer protection and financial stability. The research informs banking sector to effectively align DeFi with conventional practices providing new avenues for transparency, inclusion and efficiency. Stakeholders can better understand how to manage financial risks while using digital innovation by using Europe’s mature regulatory landscape, ultimately shaping resilient and future ready financial ecosystem.

2. Literature Review

There is considerable debate in industry and academia about blending traditional banking systems with DeFi. (Sharma & Agarwal, 2024) examined the potential advantages and disadvantages of DeFi, along with the legal implications of financial institution failures. It revealed that DeFi increases transparency, efficiency, financial inclusion and reduced reliance on intermediaries, improving banking performance. However, the study also highlighted that DeFi has certain challenges such as smart contract vulnerabilities, regulatory uncertainty, integration difficulties and cybersecurity risks. In addition, (Muhammad et al., 2024) evaluated the economic context of the complex relationship between DeFi and the well-established traditional banking industry considering the case of the UK, giving rise to this case of convergence and divergence. It has indicated that DeFi can improve efficiency and costs can be substantially reduced. According to (Zetzsche et al., 2020), local laws and compliance mechanisms have been known to reduce costs. Since the 1990s, financial services have been used through the transfer of funds for decentralisation and enable it because these policies are likely to change the economic sector. DeFi’s goal extends beyond this. It aims to build technology-driven systems that eliminate boundaries, authority, and the need for centralised control, including government oversight. It contradicts with the challenges extended by the study of (Sharma & Agarwal, 2024) indicating that the regulatory compliance increases from this approach and it leads to improved efficiency and reduced risks related to its usage. The contradiction in this literature can be highlighted due to the focus of (Zetzsche et al., 2020) study on the local laws and compliance mechanisms which indicates that such a factor can improve performance of DeFi integration.

While DeFi can potentially transform the financial industry, there is limited information about its effectiveness in traditional banking environments (Alamsyah et al., 2024). The decentralised structure of DeFi facilitates peer-to-peer transactions, which could increase efficiency. However, concerns related to scalability and compliance with existing banking regulations present challenges for its long-term adoption in European banks. DeFi uses the blockchain approach to create applications in the field of finance that are implemented on public platforms, providing complete openness, safety, and computerised programmability. Conventional risk management solutions do not apply to DeFi since they involve smart contracts other than intermediaries, which means different approaches are needed. Using smart contracts, blockchain investment protocols provide excellent opportunities for innovative projects that often struggle to gain funding from traditional investment methods (Moro-Visconti & Cesaretti, 2023). The findings can be contrasted with the other studies due to the unique challenges around regulatory compliance, scalability and risk management in the European context. Unlike traditional systems, strict oversight of Europe demands tailored framework for smart contracts, that make DeFi integration more complex yet providing structured innovation opportunities under regulated conditions.

Integrating DeFi within existing banking structures opens new prospects and creates multiple problems. DeFi, which embodies financial services, disintermediates traditional intermediaries and establishes financial inclusion, can reinvent International Business (Harvey & Rabetti, 2024). This is how DeFi is discussed, focusing on the opportunity side of the matter, frequently highlighting the concept’s efficiency, security, and transparency. Blockchain technology enables DeFi to specify how promised actions should occur between individuals. The DeFi system employs blockchain technology to execute user’s transactions in loans and trading (Li et al., 2022). Furthermore, many banking activities can be integrated into the position thanks to smart contracts available in DeFi that reduce organisational inefficiencies and human error. The services are developed in smart contracts, conventional programs containing instructions for certain financial transactions, and employed with various DeFi platforms. DeFi participants interact with software applications that coordinate the funds of other DeFi participants instead of trading with other traders. The automated and customisable technology of DeFi has the potential to improve transparency and efficiency (Auer et al., 2024).

However, the main obstacle is the lack of clarity in the regulations. The integration of DeFi, which is not centralized supervised, poses challenges for European banks operating in a highly regulated environment when it comes to following current financial regulations and consumer protection guidelines (Moro-Visconti & Cesaretti, 2023). However, American banks quickly became globalised as they realised they could improve their operations by combining retail and investment banking with European financial centers. On the other hand, the Glass-Steagall Act limited the operations of European banks in the United States (Schenk, 2021). Furthermore, trust concerns also surface; traditional banks rely on institutional trust and regulatory protections that are not present in decentralised systems, whereas DeFi promotes decentralisation and openness (Kjaer & Vetterlein, 2018). The transaction record is entered into a blockchain, an unchangeable ledger. The current structure of brokers, market makers, execution brokers, Depository Trust Clearing Corporation, and so on creates a different type of transaction. DeFi lacks a centralized exchange, human market maker, and middle layer (Harvey & Rabetti, 2024). Hence, this highlights that the regulatory conditions of the different countries such as Europe and US might differ leading to contradicting results related to the decentralisation.

The potential for DeFi to improve conventional banking services is substantial, but there are certain drawbacks. The DeFi ecosystem is still in its infancy and constantly changing; thus, there are obstacles to overcome. However, there are a lot of potential advantages, including the ability to provide quick, inexpensive, and easily accessible financial services to a far wider audience than traditional banks can (Sewpaul, 2024). By enabling safe, instantaneous, and transparent processes, blockchain technology and smart contracts have the potential to completely transform the way banks manage lending, borrowing, and asset management. The distinct recording capabilities of Blockchain render the current clearing and settlement procedure unnecessary (Javaid et al., 2022). Banks and other financial institutions are adopting blockchain-enabled IDs to verify individuals. DeFi systems’ decentralised architecture, however, brings up issues with accountability and governance. Individuals can use decentralised apps and smart contracts to engage in various financial activities under decentralised finance (DeFi) (Bourveau et al., 2024). Conventional banks function through stringent regulatory monitoring to guarantee responsibility, but DeFi employs code-based protocols without a central authority. On the other hand, the expenses associated with banks’ regulatory compliance and government agencies’ financial sector monitoring have increased (Chronopoulos et al., 2023).

The study of (Dwivedi et al., 2021) evaluated the impact of FinTech integration on the competitiveness and performance of the banking industry in the UAE by taking sample of 76 banking professionals and executives from Dubai (UAE). The findings revealed that the adoption of FinTech significantly impacted the competitiveness which improves the banking industry performance in the UAE. Furthermore, the study of (Hidayat-ur-Rehman & Hossain, 2024) evaluated the impact of Fintech and digital transformation on the bank competitiveness and performance using 438 banking employees in Pakistan. The findings indicated significant impact of Fintech adoption and digital transformation on the sustainable performance of banks. The study of (Dasilas & Karanović, 2025) evaluated the impact of Fintech on bank performance using data from the UK banking sector for period of 2010 to 2019. The findings indicated that Fintech firms positively impact bank performance by improving net interest margin, and yield on earning assets. However, the study of (Bourveau et al., 2024) indicated that Fintech and Digitisation can only improve the bank performance when it integrates the technology and regulations intricately. Hence, the weak regulations or weak use of technology cannot provide significant bank performance. It indicates that the countries where regulations are uncertain or there are not much technological advancements, the results can differ. Hence, it can be hypothesised that;

H1: Digitalisation and Fintech adoption have a positive and significant impact on the performance of banks in Europe.

(Mahmud et al., 2023) conducted the study in Bangladesh to reveal potential of DeFi for banking performance. It contend that DeFi can undermine the intermediary role of traditional banking, possibly lowering deposits and destabilising small banks, particularly without systemic adaptability. For (Asl & Jabeur, 2024), employing wavelet and quantile analyses using global datasets, find connectivity between DeFi and CeFi to be limited in extreme market states, which indicates the integrating impacts depend on context. (Ali, 2024) conducted the study to evaluate the benefit of DeFi for the banking efficiency and performance in Bangladesh. It provides a more mixed perspective with operational efficiencies, inclusion, and collaborative opportunities pointed out. They differ based on methodological angles, qualitative policy examination, sophisticated statistical modeling, and regulatory examination, each highlighting unique angles such as disruption, interconnectivity, and sustainability, respectively. Therefore, it can be hypothesised that;

H2: Integration of DeFi solutions have a positive and significant impact on the performance of banks in Europe.

(Nguyen et al., 2022), with the evidence of 73 countries, discovered that tighter bank regulations increase stability and profitability, revealing regulation’s significant role. (Audi & Al-Masri, 2024), with emphasis on 100 emerging market banks, also verified that tight regulatory structures reduce risk-taking, especially during turbulent credit conditions. Conversely, (Mahmud et al., 2023) examined global upsets caused by DeFi, highlighting that if regulatory evolution does not occur, legacy banks can be disintermediated. The studies contradicting review highlights that the regulatory framework of the countries are significant as the countries with regulatory uncertainties can lead to poor banking performance as a result of adopting DeFi. Therefore, it can be hypothesised that;

H3: Regulatory environment have a positive and significant impact on the performance of banks in Europe.

(Nguyen et al., 2022), comparing data from 73 nations, revealed that fintech credit growth, fueled by operational efficiency, diminishes bank profitability because of enhanced competition, while financial stability is increased. (Ali et al., 2024), dealing with Bangladesh and emerging economies, emphasised that operational efficiency of DeFi reduces transaction costs and increases service delivery, encouraging banks to innovate in order to survive. (Mahmud et al., 2023), examining global disruption, argued DeFi’s efficiency could eliminate banks’ intermediary role if adaptation is lacking. Nguyen studied fintech broadly across developed and developing economies, while Ali and Mahmud focused on DeFi’s transformative potential in less mature banking systems. Hence, the findings differ in the context where the banking system is less mature. Based on these findings, following hypothesis has been obtained;

H4: Operational efficiency have a positive and significant impact on the performance of banks in Europe.

(Adamyk et al., 2025), in the UK context, analysed DeFi platforms’ contribution to the handling of decentralised risks and opined that better monitoring and compliance tools have a secondary supporting impact on conventional bank stability. (Harb et al., 2022), examining MENA banks, discovered that the management of combined liquidity and credit risk enhances market and accounting performance, particularly when risk management approaches are used collectively. (Ogundele & Nzama, 2025), with a focus on Nigerian banks, demonstrated that though liquidity risk disclosure improves performance, low credit risk practices reduce it. Variability stems from regional financial infrastructure, UK banks take advantage of advanced tech tools, MENA banks emphasise governance synergy, while Nigerian banks are constrained by structural as well as disclosure issues. Hence, it is hypothesised that;

H5: Risk and Safety measures have a positive and significant impact on the performance of banks in Europe.

2.1. Literature Gap

Despite its potential, research on integrating decentralised finance (DeFi) into traditional banking is severely lacking. Current research highlights the theoretical advantages, including lower costs, greater efficiency, and transparency (Harvey & Rabetti, 2024; Li et al., 2022). Still, empirical data is absent from actual usage, especially in Europe’s highly regulated banks. Few studies have examined DeFi’s ability to comply with strict financial regulations; regulatory clarity remains a vital barrier (Zetzsche et al., 2020). Hybrid methods may not be viable in the long run due to the performance feedback they provide through the constant expansion of DeFi. Finally, it is doubtful that DeFi will promote financial inclusion because it has services and technologies many individuals may not access (Sewpaul, 2024).

2.2. Conceptual Framework

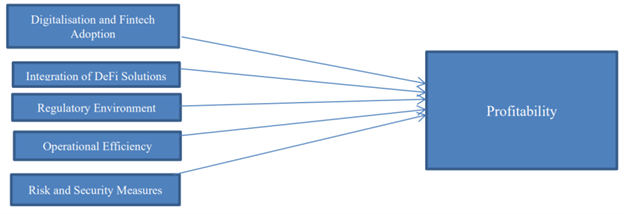

This conceptual study uses themes from previous literature to analyse European banks’ profitability as the dependent variable, integrating DeFi, digitization, fintech, regulatory setting, operational effectiveness, and risk and security controls as explanatory variables as depicted in Fig. (1). The hypotheses reflect these relationships: DeFi integration is expected to increase profitability due to the reduction of costs and improvements of services (Harvey & Rabetti, 2024), and through digitization and FinTech, the company will continue to innovate through a further decrease in operational expenses (Zetzsche et al., 2020). The presence of an environment that supports the adoption of innovative financial technologies contributes significantly to profitability (Schenk, 2021) and (ii) increased profitability due to the exclusion of human error and high operational efficiency resulting from the use of automated processes (Li et al., 2022). Robust risk and security are the key factors underlying trust and stability, which affect profitability in a straight line (Chronopoulos et al., 2023). The paper presents a conceptual model of these relations and how these independent variables determine the performance of European banks, which serves as a model for empirical analysis.

3. METHODOLOGY

3.1. Sample and Data Collection

The data collection for this study was done through structured survey questionnaire developed to evaluate perceptions related to role of hybrid models integrating DeFi and traditional banking systems to increase European banks performance. The questionnaire used a five-point Likert scale ranging from “strongly agree” to “strongly disagree” for capturing respondent’s level of agreement with various statements related to hybrid financial models, operational efficiency and customer experience (Appendix A). The sampling was done using purposive sampling technique, targeting financial professionals, banking executives, and Fintech specialists across different European countries namely Germany, France, the Netherland, Sweden and Estonia. These countries are selected due to their advanced financial infrastructures, progressive regulatory environments and active participation in both traditional banking and emerging DeFi ecosystems (Ilsøe et al., 2022). This strategic selection ensured that participants had the requisite expertise and contextual understanding to offer meaningful insights. However, the use of purposive sampling makes the study prone to selection bias (López, 2023). The targeted sample size for this research was calculated using the Cochrane formula as per (Nanjundeswaraswamy, & Divakar, 2021) as shown below. The formula provided sample size of 384 and hence the target was to attain the responses from 384 participants.

n= 384

Where:

- n = sample size

- Zα/2 = Z value for the chosen confidence level (typically 1.96 for 95% confidence)

- p = estimated proportion (here assumed as 0.5 for maximum variability)

- E = margin of error (desired precision)

Hence, the questionnaire was distributed to 700 participants to ensure that the target respondents are attained and the responses are free of biases. Out of 700, only 398 were filled providing 57% response rate. The received responses were cleaned for missing data and outliers and hence the final sample was comprised of 381 responses.

Fig. (1). Conceptual Framework.

3.2. Removing Potential Biases

There are certain potential biases in the research which can impact on the study transparency and hence it is important to address them. The selection bias is the most important when using the purposive sampling. The selection bias has been reduced by recruiting participants from different backgrounds, specially targeting financial professionals, banking executives, and Fintech specialists in different European countries. It ensured that the study has taken diverse perspectives. (Abobakr et al., 2024) confirmed that when participants are selected based on different backgrounds and platforms ensure bias free sampling. Furthermore, the use of LinkedIn, personal contacts and face to face visit has ensured that participants were selected bias free across different platforms and backgrounds.

Furthermore, it is also necessary to address common method bias which might occur due to same method for measuring independent and dependent variable (Kock et al., 2021). The bias can be detected and mitigated using Harman’s single factor test where exploratory factor analysis (EFA) is tested on the entire scale extracting a single factor. The total variance extracted of the first factor must be below 50% to indicate that common method bias does not exist (Baumgartner & Weijters, 2021). Since, the EFA indicated total variance extracted for first factor as 44%, therefore, the common method bias is not an issue in this study.

Additionally, it was also important to check for the non-response bias to ensure transparency of the outcomes. The study of (Dióssy et al., 2025; and Malik et al., 2024) indicated that non-response bias can be evaluated by checking the differences between the early and late respondents since late respondents have similar characteristics to non-respondents. The independent sample t-test was used to compare statistical difference between early respondents (n1= 30) and late respondents (n2=30). The results indicated that digitization and Fintech adoption (MD= 0.15, P-value= 0.555), integration of DeFi Solutions (MD= 0.28, P-value= 0.154), regulatory environment (MD= 0.133, P-value= 0.626), operational efficiency (MD= 0.33, P-value= 162), risk and security measures (MD= -0.066, P-value= 0.804) and performance (MD= -0.011, P-value= 0.964) has insignificant mean difference. Since no construct has revealed any statistically significant differences across n1 and n2 therefore there is no issue of non-response bias in the dataset.

3.3. Measurement of Variables

Digitisation and Fintech Adoption is measured using items that evaluate the level to which the banks embrace digital platforms, mobile banking, AI-based services, and automated customer service (Von Kalckreuth et al., 2021). Some examples of sample items include “Our bank uses AI for customer service” and “Fintech tools have improved our service delivery.”

DeFi Solutions is quantified by measuring the utilisation of blockchain, smart contracts, and decentralised platforms in financial processes (Adamyk et al., 2025). Examples like “Our bank leverages blockchain-based finance solutions” reflect the integration level.

Regulatory environment is measured by gauging how favorable and clear the regulation policies are with respect to Fintech and DeFi (Zetzsche et al., 2020). Examples are “Regulatory policies promote Fintech innovation in our region” and “Compliance procedures are clearly defined.”

Operational Efficiency is assessed by looking at process automation, cost cutting, and speed of service delivery (Uzougbo et al., 2024). Example items are “Automation has lowered our operational expenses” and “Digitization has accelerated service delivery times.”

Risk and Security Measures are assessed via items reviewing cybersecurity infrastructure, fraud detection mechanisms, and compliance policies (Adamyk et al., 2025). For instance, “Our bank possesses a robust cybersecurity infrastructure” and “We update our risk mitigating policies regularly.”

Bank Performance is evaluated with both subjective and objective measures such as customer satisfaction, revenue growth, and innovation results (Wang et al., 2023). Examples include “Our bank has demonstrated performance growth owing to Fintech adoption.”

3.4. Data Analysis

The data was analysed using PLS-SEM using smart PLS. PLS-SEM is important for exploratory and predictive studies with multiple latent constructs. The analysis was conducted using two distinct phases, that includes measurement model and structural model. Measurement model evaluates the construct validity and reliability along with the indicator’s loadings. Factor loading values above 0.6 shows the validity of the indicators and Cronbach’s alpha and composite reliability above 0.7 is considered to be reliable. AVE values above 0.5 are considered to indicate convergent validity whereas HTMT ratio below 0.85 is used to ensure discriminant validity (Ringle et al., 2015). The structural model contains path coefficient and significance levels. The process helps in the concurrent evaluation of measurement quality and structural relations, providing comprehensive understanding of the predictive power of the model.

4. ANALYSIS

4.1. Demographic Characteristics

Table 1 below highlights the respondents’ ages, genders, roles, experiences, and educational backgrounds in the banking sector. According to the age distribution, the largest group of respondents (17.5%) is over 40, while the majority (25%) are in the 36–40 age range. With more than 57% of the workforce under 35, this suggests that the industry has a comparatively younger workforce. The respondents were generally evenly distributed by gender, although there were more women (35.5%) and other responders (37%) than men (27.5%). This gender diversity reflects the substantial representation of women and non-binary people in the banking sector. According to the respondents’ jobs at the bank, the largest group consisted of customer managers (24%), followed by branch managers (21.5%) and managers (20%). This suggests that a wide range of managerial levels have different tasks. The sector’s diversity in employment functions is shown in the 19% and 15.5% of roles held by cashiers and other roles, respectively.

Table 1. Demographic profile of the respondents.

| Demographic Category | Category | Frequency | Percent |

|---|---|---|---|

| Age | Up to 25 | 78 | 20.50% |

| 26 to 30 | 70 | 18.50% | |

| 31 to 35 | 70 | 18.50% | |

| 36 to 40 | 95 | 25.00% | |

| Above 40 | 67 | 17.50% | |

| Gender | Male | 105 | 27.50% |

| Female | 135 | 35.50% | |

| Others | 141 | 37.00% | |

| Role in Bank | Manager | 76 | 20.00% |

| Branch Manager | 82 | 21.50% | |

| Customer Manager | 91 | 24.00% | |

| Cashier | 72 | 19.00% | |

| Others | 59 | 15.50% | |

| Experience | 1-3 years | 84 | 22.00% |

| 4-5 years | 105 | 27.50% | |

| 5-6 years | 46 | 12.00% | |

| 7-8 years | 80 | 21.00% | |

| More than 8 years | 67 | 17.50% | |

| Education Level | Graduation | 65 | 17.00% |

| Masters | 76 | 20.00% | |

| MPhil | 84 | 22.00% | |

| Doctoral | 86 | 22.50% | |

| Professional Certification | 70 | 18.50% |

In terms of experience, the most frequent experience range was 4-5 years, held by 27.5% of respondents. The sample included a mix of professionals in their mid-career and those who were comparatively fresher, as evidenced by the large percentage (22%) with 1-3 years of experience and the 21% with 7-8 years. According to the analysis of education levels, most respondents have advanced degrees; 22.5 percent have a doctorate, and 22% have an M.Phil., indicating a highly educated workforce. A smaller portion (17%) said they just had a bachelor’s degree, suggesting they prefer to work in banking, where more education is valued.

4.2. Measurement Model using Confirmatory Factor Analysis (CFA)

Table 2 shows the measurement model using CFA. The factor loadings values are considered to confirm the validity of indicators where value of factor loadings above 0.6 is considered (Ringle et al., 2015). The values of factor loadings for all the indicators below shows that they are above 0.6 and hence confirms validity of indicators and no construct needs to be removed. Cronbach’s alpha and composite reliability has been used to evaluate the reliability of the constructs where value of above 0.7 is considered. The constructs in Table 2 shows the values of above 0.7 for both Cronbach’s alpha and composite reliability. AVE is used to evaluate the convergent validity where value is considered above 0.5. Since, AVE for all constructs in Table 2 shows values above 0.5, hence it confirms convergent validity.

Table 2. Measurement model using CFA.

| Latent Constructs | Indicators | Factor Loadings | Cronbach's Alpha | Composite Reliability | Average Variance Extracted (AVE) |

|---|---|---|---|---|---|

| Digitisation and Fintech Adoption | DFA1 | 0.883 | 0.852 | 0.858 | 0.771 |

| DFA2 | 0.906 | ||||

| DFA3 | 0.845 | ||||

| Integration of DeFi Solutions | IDS1 | 0.815 | 0.814 | 0.818 | 0.730 |

| IDS2 | 0.902 | ||||

| IDS3 | 0.845 | ||||

| Operational Efficiency | OE1 | 0.906 | 0.901 | 0.903 | 0.835 |

| OE2 | 0.934 | ||||

| OE3 | 0.901 | ||||

| Performance | P1 | 0.860 | 0.858 | 0.859 | 0.779 |

| P2 | 0.905 | ||||

| P3 | 0.881 | ||||

| Regulatory Environment | RE1 | 0.892 | 0.884 | 0.884 | 0.812 |

| RE2 | 0.925 | ||||

| RE3 | 0.886 | ||||

| Risk and Safety Measures | RSM1 | 0.898 | 0.894 | 0.895 | 0.826 |

| RSM2 | 0.939 | ||||

| RSM3 | 0.888 |

Table 3 shows discriminant validity of the constructs. It has been elaborated that the HTMT ratio has to be below 0.85 (Hair et al., 2017). The table above shows that the value of each variable is below 0.85, showing that the data is not violated for the assumption of the discriminant validity.

Table 3. Discriminant validity.

| Digitisation and Fintech Adoption | Integration of DeFi Solutions | Operational Efficiency | Performance | Regulatory Environment | |

|---|---|---|---|---|---|

| Integration of DeFi Solutions | 0.618 | ||||

| Operational Efficiency | 0.608 | 0.464 | |||

| Performance | 0.315 | 0.408 | 0.524 | ||

| Regulatory Environment | 0.718 | 0.547 | 0.731 | 0.509 | |

| Risk and Safety Measures | 0.276 | 0.340 | 0.479 | 0.738 | 0.495 |

4.3. Path Analysis

Table 4 shows path analysis to confirm the hypothesis. It shows that digitization and Fintech adoption (B= -0.020, P-value= 0.650) has a negative and insignificant impact on bank performance. Integration of DeFi solution (B= 0.083, P-value= 0.025) have a positive and significant impact on bank performance. Operational efficiency (B= 0.103, P-value= 0.035) have a positive and significant impact on bank performance. Furthermore, regulatory environment (B= 0.021, P-value= 0.674) are indicated to have insignificant and positive impact on bank performance. Risk and safety measures (B= 0.749, P-value= 0.000) have positive and significant impact on bank performance.

Table 4. Path analysis.

| Path Coefficient | T Statistics | P Values | |

|---|---|---|---|

| Digitisation and Fintech Adoption -> Performance | -0.020 | 0.453 | 0.650 |

| Integration of DeFi Solutions -> Performance | 0.083** | 2.245 | 0.025 |

| Operational Efficiency -> Performance | 0.103** | 2.104 | 0.035 |

| Regulatory Environment -> Performance | 0.021 | 0.421 | 0.674 |

| Risk and Safety Measures -> Performance | 0.749*** | 23.016 | 0.000 |

Note: *** indicates significance at 1%, ** indicates significance at 5%, * indicates significance at 10%

4.4. Model Explanatory Power

Table 5 below shows the model explanatory power. It shows the value of 0.696 or 69.6% which shows that 69.6% variation in bank performance is explained through the variations in digitization and Fintech adoption, integration of DeFi solutions, operational excellence, regulatory environment and risk and safety measures.

Table 5. Model explanatory power.

| R-Square | R-Square Adjusted | |

|---|---|---|

| Performance | 0.696 | 0.692 |

5. DISCUSSION

The purpose of this study is to evaluate the impact of DeFi and traditional banking on the bank performance of European banks. First, Digitisation and Fintech Adoption (H1) had a negative, but statistically insignificant effect on bank performance (B = -0.020, p = 0.650). Contrary to previous research like (Kou et al., 2021), who put forward that digital innovation improves organisational efficiency, customer satisfaction, and competitive power. The reason for contradictory findings is due to the saturation in European Fintech landscapes, wherein digital technologies are already embedded but have not produced commensurate performance gains. Furthermore, institutional resistance and regulatory conservatism in Europe can hold back the agility required to effectively exploit Fintech improvements (Chronopoulos et al., 2023). To improve impact, banks must go beyond surface-level digitisation and pursue strategic digital transformation aligned with operational and customer-centric goals.

In contrast, the integration of DeFi solutions (H2) showed a positive and statistically significant impact (B = 0.083, p = 0.025), confirming the literature’s optimistic outlook on DeFi’s transformative potential. (Moro-Visconti & Cesaretti, 2023) posit that DeFi facilitates financing for projects which are approaching traditional finance by virtue of smart contracts and blockchain-based investing protocols. Similarly, (Harvey & Rabetti, 2024) pointed out the disintermediation and financial inclusiveness potential of DeFi. This observation indicates that European banks, being conservatively risk-averse in the first place, are now finding decentralised instruments to enhance investment efficiency as well as broaden services, even in highly regulated settings.

Nonetheless, the regulatory environment (H3) positively but statistically insignificantly affected (B = 0.021, p = 0.674), contrary to (Zetzsche et al., 2020)’s argument that local laws and compliance procedures decrease costs. This is likely due to the strictness and complexity of European financial regulations, which hamper innovation as well as slow down embracing nascent technologies such as DeFi. Moreover, cultural considerations like institutional risk aversion and preference for centralised control render structures of regulation seem more constricting than facilitating (Kjaer & Vetterlein, 2018). In solving this, an adoption of principles-based regulation to provide greater flexibility while still ensuring control is essential.

Operational effectiveness (H4) significantly positively influenced (B = 0.103, p = 0.035), consistent with (Auer et al., 2024), who characterise DeFi systems as automated, transparent, and human-error reducing. With banks prioritising operations optimisation in the face of increasing costs, taking advantage of DeFi’s adaptability may assist in lowering administrative load and processing times. Lastly, risk and safety controls (H5) had the highest positive and significant influence (B = 0.749, p = 0.000). This agrees with (Javaid et al., 2022), which emphasises that blockchain’s immutable ledger can enhance asset management, lending, and settlement. As legacy banks, bank on institutional trust and regulatory cover, infusing DeFi systems with effective cybersecurity protocols and auditable smart contracts can aid compliance and enhance trust. (Bourveau et al., 2024).

A number of strategic and structural reforms are required to enhance the contribution of DeFi and legacy financial innovations to European banking performance. Banks need to transition first from shallow digitisation to deep digital integration, combining fintech with core business models as well as customers’ needs. It involves investing in AI-backed analytics, real-time service, and enriched UX design. Second, regulatory models should shift towards a more adaptable, principle-based framework that is open to experimentation while sustaining checks and balances, that are essential for DeFi adoption. Collaborative collaboration between regulators, banks, and DeFi innovators can create mutual awareness and co-design adaptive compliance models. Third, institutional cultural shift is essential to overcome risk aversion. This is achieved by establishing internal innovation units and upskilling personnel in blockchain and smart contract technologies. Finally, having standardized risk and cybersecurity procedures between DeFi platforms can foster confidence, provide compatibility, and defend against attacks, rendering DeFi a credible addition to traditional banking services in Europe.

CONCLUSION AND RECOMMENDATION

This research analysed the effect of DeFi integration and conventional bank factors on the performance of European banks. The results show that digitisation and regulatory environment contribute insignificantly, whereas DeFi integration, operational efficiency, and risk and safety measures strongly increase bank performance. Particularly, DeFi has a very promising route to innovation, efficiency, and financial inclusion if supported by strong security and smart contract mechanisms. Yet, established digitisation efforts seem full to the brim, and excessively rigid regulatory frameworks might discourage future innovation. Drawing on these conclusions, some recommendations follow. European banks must move from fintech adoption on the surface to meaningful digital transformation that incorporates new technologies into core business. Building cooperation between regulators, DeFi developers, and banks will be crucial to collaborate on developing dynamic, future-resistant financial ecosystems that combine the best of traditional and decentralised finance models, delivering sustainable improvement in performance across the European banking industry.

POLICY IMPLICATIONS

The results of this research have significant policy implications for financial institutions and regulators in Europe. The strong performance impact of DeFi integration implies that regulators need to create a more accommodative environment for innovation. It involves creating transparent, flexible, and principle-based regulatory frameworks that permit experimentation with DeFi while preserving consumer protection and financial stability. Policymakers also need to fill the regulatory gap between centralised and decentralised systems by revising compliance standards to account for the reality of smart contracts, decentralised governance, and blockchain-based transactions. In addition, cooperation between financial, data protection, and cyber security agencies is essential to develop harmonised and congruent policies that facilitate secure and transparent DeFi implementation. Encouraging sandboxing and public-private collaborations can help drive responsible innovation in a timely manner. By facilitating a regulatory framework that ensures risk management and innovation, policymakers can ensure that DeFi adds value to banking performance and the European financial system.

LIMITATIONS AND FUTURE DIRECTIONS

This research, although valuable, has a number of limitations. To begin with, the use of cross-sectional data constrains identifying long-term impacts as well as causal factors between DeFi adoption and bank performance. Secondly, the concentration on European banks can mean that results could not be generalised to other regions that have varied regulatory, cultural, and technological environments. Lastly, the research is mainly based on quantitative variables, which can miss subtle managerial and operational intelligence that qualitative methods could identify. For prospective research, longitudinal studies would be beneficial to measure the changing influence of DeFi over a period of time. Cross-regional comparison studies can also uncover how institutional and cultural aspects impact adoption rates. Case studies or interviews with regulators and bank CEOs can also present more qualitative insights into the real-world challenges and implications of integrating DeFi. Researching consumer trust, digital literacy, and access to DeFi instruments would also help understand its wider implications for financial inclusion.

Consent For Publication

Not applicable.

Availability of Data and Materials

The data will be made available on reasonable request by contacting the corresponding author [A.A.A].

Funding

None.

Conflict of Interest

The authors declare that there is no conflict of interest regarding the publication of this article.

Acknowlegdements

Declared none.

APPENDIX A: QUESTIONNAIRE

Section A: Demographic Profile

Age

a) Up to 25

b) 26 to 30

c) 31 to 35

d) 36 to 40

e) Above 40- Gendera) Male

b) Female

c) Others - Role in Banka) Manager

b) Branch Manager

c) Customer Manager

d) Cashier

e) Others - Experiencea) 1-3 years

b) 4-5 years

c) 5-6 years

d) 7-8 years

e) More than 8 years - Education Levela) Graduation

b) Masters

c) M. Phil

d) Doctoral

e) Professional Certification

Section B: Digitisation and Fintech Adoption

Rate following statement based on five-point scale

(1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree).

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Our bank has adopted mobile and digital banking platforms to enhance customer experience. | |||||

| We utilise Fintech solutions to improve financial services and processes. | |||||

| The integration of artificial intelligence has improved customer interaction and service delivery. |

Section C: DeFi Solutions

Rate following statement based on five-point scale

(1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree).

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Our bank is exploring or adopting blockchain technologies for financial operations. | |||||

| We are developing or using smart contracts to improve transaction efficiency. | |||||

| The bank is actively involved in researching or implementing decentralised finance applications. |

Section D: DeFi Solutions

Rate following statement based on five-point scale

(1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree).

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Our bank is exploring or adopting blockchain technologies for financial operations. | |||||

| We are developing or using smart contracts to improve transaction efficiency. | |||||

| The bank is actively involved in researching or implementing decentralised finance applications. |

Section E: Regulatory Environment

Rate following statement based on five-point scale

(1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree).

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Current regulations support innovation and adoption of Fintech and DeFi technologies. | |||||

| Regulatory guidelines related to Fintech and digital finance are clear and well-defined. | |||||

| Our bank has a strong relationship with regulators concerning digital | |||||

| financial services. |

Section F: Operational Efficiency

Rate following statement based on five-point scale

(1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree).

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Automation and digitization have led to faster and more efficient banking operations. | |||||

| Digital tools have helped reduce operational costs in our bank. | |||||

| Technology adoption has streamlined internal processes and decision-making. |

Section G: Risk and Security Measures

Rate following statement based on five-point scale

(1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree).

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Our bank has implemented strong cybersecurity systems to protect digital operations. | |||||

| We regularly update our risk management policies to address digital threats. | |||||

| Fraud detection and prevention technologies are effectively used in our digital services. |

Section H: Bank Performance

Rate following statement based on five-point scale

(1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree).

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Fintech and digital solutions have positively impacted our bank’s overall performance. | |||||

| There has been noticeable growth in customer satisfaction due to technology adoption. | |||||

| Our financial performance has improved through the implementation of digital innovation. |

References

Abobakr, M. A., Abdel-Kader, M., & F. Elbayoumi, A. F. (2024). An experimental investigation of the impact of sustainable ERP systems implementation on sustainability performance. Journal of Financial Reporting and Accounting. https://doi.org/10.1108/JFRA-04-2023-0207.

Adamyk, B., Benson, V., Adamyk, O., & Liashenko, O. (2025). Risk Management in DeFi: Analyses of the Innovative Tools and Platforms for Tracking DeFi Transactions. Journal of Risk and Financial Management, 18(1), 38. https://doi.org/10.3390/jrfm18010038.

Alamsyah, A., Kusuma, G. & Ramadhani, D., (2024). A Review on Decentralized Finance Ecosystems. Future Internet, 16(3), p. 76. https://doi.org/10.3390/fi16030076.

Ali, A. (2024). Decentralized Finance (DeFi) and Its Impact on Traditional Banking Systems: Opportunities, Challenges, and Future Directions. Challenges, and Future Directions (August 01, 2024). http://dx.doi.org/10.2139/ssrn.4942313.

Ali, K., Shahzad, A. & Chaudhary, H., (2024). The Role of Decentralized Finance (DeFi) in Reshaping Global Financial Inclusion: Opportunities and Risks. Social Science Review Archives, 2(2), pp. 560-579. https://policyjournalofms.com/index.php/6/article/view/103.

Anoop, V. S. & Goldston, J., (2022). Decentralized finance to hybrid finance through blockchain: A case study of Acala and current. Journal of Banking and Financial Technology, 6(1), p. 109–115. https://doi.org/10.1007/s42786-022-00041-0.

Asl, M. G., & Jabeur, S. B. (2024). Tail connectedness of DeFi and CeFi with accessible banking pillars: Unveiling novel insights through wavelet and quantile cross-spectral coherence analyses. International Review of Financial Analysis, 95, 103424. https://doi.org/10.1016/j.irfa.2024.103424.

Audi, M., & Al-Masri, R. (2024). Examining the Impacts of Regulatory Framework on Risk in Commercial Banks in Emerging Economies. https://mpra.ub.uni-muenchen.de/121587/.

Auer, R., Haslhofer, B., Kitzler, S., Saggese, P., & Victor, F. (2024). The technology of decentralized finance (DeFi). Digital Finance, 6(1), 55-95. https://doi.org/10.1007/s42521-023-00088-8.

Baumgartner, H., & Weijters, B. (2021). Dealing with common method variance in international marketing research. Journal of International Marketing, 29(3), 7-22. https://doi.org/10.1177/1069031X21995871.

Ben Jabra, W., Mighri, Z. & Mansouri, F., (2017). Determinants of European bank risk during the financial crisis. Cogent Economics & Finance, 5(1), p. 1298420. https://doi.org/10.1080/23322039.2017.1298420.

Bourveau, T., Brendel, J. & Schoenfeld, J., (2024). Decentralized Finance (DeFi) assurance: early evidence. Review of Accounting Studies, 29(3), pp. 2209-2253. https://doi.org/10.1007/s11142-024-09834-8.

Chronopoulos, D., Wilson, J. & Yilmaz, M., (2023). Regulatory oversight and bank risk. Journal of Financial Stability, 64, p. 101105. https://doi.org/10.1016/j.jfs.2023.101105.

Dasilas, A., & Karanović, G. (2025). The impact of FinTech firms on bank performance: evidence from the UK. EuroMed Journal of Business, 20(1), 244-258. https://doi.org/10.1108/EMJB-04-2023-0099.

Dióssy, K., Losonci, D., Aranyossy, M., & Demeter, K. (2025). The role of leadership in digital transformation–a paradox way to improve operational performance. Journal of Manufacturing Technology Management, 36(9), 88-113. https://doi.org/10.1108/JMTM-07-2024-0386.

Dwivedi, P., Alabdooli, J. I., & Dwivedi, R. (2021). Role of FinTech adoption for competitiveness and performance of the bank: a study of banking industry in UAE. International Journal of Global Business and Competitiveness, 16(2), 130-138. https://doi.org/10.1007/s42943-021-00033-9.

Ferreira, A., (2024). Decentralized finance (DeFi): the ultimate regulatory frontier? Capital Markets Law Journal, 19(3), pp. 242-259. https://doi.org/10.1093/cmlj/kmae007.

Gogol, K., Killer, C., Schlosser, M., Bocek, T., Stiller, B., & Tessone, C., (2024). SOK: Decentralized Finance (DeFi)–Fundamentals, Taxonomy and Risks. p. 11281.

Hair, J., Hollingsworth, C. L., Randolph, A. B., & Chong, A. Y. L. (2017). An updated and expanded assessment of PLS-SEM in information systems research. Industrial management & data systems, 117(3), 442-458. https://doi.org/10.1108/IMDS-04-2016-0130.

Harb, E., El Khoury, R., Mansour, N., & Daou, R. (2022). Risk management and bank performance: evidence from the MENA region. Journal of Financial Reporting and Accounting, 21(5), 974-998. https://doi.org/10.1108/JFRA-07-2021-0189.

Harvey, C. & Rabetti, D., (2024). International business and decentralized finance. Journal of International Business Studies, pp. 1-24. https://doi.org/10.1057/s41267-024-00705-7.

Hidayat-ur-Rehman, I., & Hossain, M. N. (2024). The impacts of Fintech adoption, green finance and competitiveness on banks’ sustainable performance: digital transformation as moderator. Asia-Pacific Journal of Business Administration. https://doi.org/10.1108/APJBA-10-2023-0497.

Ilsøe, A., Karma, K., Larsen, T. P., Larsson, B., Lehr, A., Masso, J., & Rolandsson, B. (2022). The Digital Transformation Of Financial Services Markets And Industrial Relations–Exploring FinTech development in Denmark, Estonia, the Netherlands and Sweden. https://hdl.handle.net/2077/71585.

Javaid, M., Haleem, A., Singh, R. P., Suman, R., & Khan, S. (2022). A review of Blockchain Technology applications for financial services. BenchCouncil transactions on benchmarks, standards and evaluations, 2(3), 100073. https://doi.org/10.1016/j.tbench.2022.100073.

Kjaer, P. & Vetterlein, A., (2018). Regulatory governance: rules, resistance and responsibility. Contemporary Politics, 24(5), pp. 497-506. https://doi.org/10.1080/13569775.2018.1452527.

Kock, F., Berbekova, A., & Assaf, A. G. (2021). Understanding and managing the threat of common method bias: Detection, prevention and control. Tourism management, 86, 104330. https://doi.org/10.1016/j.tourman.2021.104330.

Kou, G., Olgu Akdeniz, Ö., Dinçer, H. & Yüksel, S., (2021). Fintech investments in European banks: a hybrid IT2 fuzzy multidimensional decision-making approach. Financial innovation, 7(1), p. 39. https://doi.org/10.1186/s40854-021-00256-y.

Li, W., Bu, J., Li, X., Peng, H., Niu, Y., & Zhang, Y. (2022). A survey of DeFi security: Challenges and opportunities. Journal of King Saud University-Computer and Information Sciences, 34(10), 10378-10404. https://doi.org/10.1016/j.jksuci.2022.10.028.

López, M. (2023). The effect of sampling mode on response rate and bias in elite surveys. Quality & Quantity, 57(2), 1303-1319. https://doi.org/10.1007/s11135-022-01406-9.

Mahmud, S., Wahid, T., Chowdhury, A. N., & Ekra, M. J. (2023). The implication of DeFi (Decentralized Finance) in disrupting the global banking system. Available at SSRN 4491898. http://dx.doi.org/10.2139/ssrn.4491898.

Malik, M., Andargoli, A., Clavijo, R. C., & Mikalef, P. (2024). A relational view of how social capital contributes to effective digital transformation outcomes. The Journal of Strategic Information Systems, 33(2), 101837. https://doi.org/10.1108/IJOPM-01-2022-0072.

Momtaz, P., (2024). Decentralized finance (DeFi) markets for startups: search frictions, intermediation, and the efficiency of the ICO market. Small Business Economics, pp. 1-33. https://doi.org/10.1007/s11187-024-00886-3.

Moro-Visconti, R. & Cesaretti, A., (2023). Decentralized Finance (DeFi). Digital Token Valuation: Cryptocurrencies, NFTs, Decentralized Finance, and Blockchains, pp. 287-340. https://doi.org/10.1007/978-3-031-42971-2_9.

Muhammad, A., Ishaq, A. A., Mike, M. E. E., Ibitomi, T., Ishaq, N. A., & Isyaku, M. (2024). Decentralized finance (DeFi) and traditional banking: A convergence or collision. Economics, Politics and Regional Development, 1(1), p. 5. https://academicpinnacle.com/index.php/JIT/article/view/16.

Nanjundeswaraswamy, T. S., & Divakar, S. (2021). Determination of sample size and sampling methods in applied research. Proceedings on engineering sciences, 3(1), 25-32. 10.24874/PES03.01.003.

Nguyen, L., Tran, S., & Ho, T. (2022). Fintech credit, bank regulations and bank performance: A cross-country analysis. Asia-Pacific Journal of Business Administration, 14(4), 445-466. https://doi.org/10.1108/APJBA-05-2021-0196.

Ogundele, O. S., & Nzama, L. (2025). Risk Management Practices and Financial Performance: Analysing Credit and Liquidity Risk Management and Disclosures by Nigerian Banks. Journal of Risk and Financial Management, 18(4), 198. https://doi.org/10.3390/jrfm18040198.

Ringle, C., Da Silva, D., & Bido, D. (2015). Structural equation modeling with the SmartPLS. Bido, D., da Silva, D., & Ringle, C. (2014). Structural Equation Modeling with the Smartpls. Brazilian Journal Of Marketing, 13(2). https://ssrn.com/abstract=2676422.

Sadati, A., Gramlich, D. & Walker, T., (2024). Artificial Intelligence, Finance, and Sustainability: An Overview. Artificial Intelligence, Finance, and Sustainability: Economic, Ecological, and Ethical Implications, Issue 3-16. https://doi.org/10.1007/978-3-031-66205-8_1.

Schenk, C., (2021). The global financial crisis and banking regulation: Another turn of the wheel?. Journal of Modern European History, 19(1), pp. 8-13. https://doi.org/10.1177/1611894420974252.

Schuler, K., Cloots, A. & Schär, F., (2024). On DeFi and On-Chain CeFi: How (Not) to Regulate Decentralized Finance.. Journal of Financial Regulation, p. fjad014. https://doi.org/10.1093/jfr/fjad014.

Sewpaul, S., (2024). How DeFi Is Challenging And Changing Traditional Banking. [Online] Available from: https://www.forbes.com/councils/forbesbusinesscouncil/20 24/09/25/how-defi-is-challenging-and-changing-traditional-banking/#:~:text=Traditional%20banks%20are%20often%20slow,of%20new%20products%20and%20services.

Sharma, H. & Agarwal, S., (2024). The Impact of Decentralized Finance (DeFi) on Traditional Financial Systems: Opportunities, Challenges, and Regulatory Implications. The AI Revolution. Driving Business Innovation and Research, 2, pp. 211-218. https://doi.org/10.1007/978-3-031-54383-8_17.

Thottoli, M. M., Islam, M. A., Yusof, M. F. B., Hassan, M. S., & Hassan, M. A. (2023). Embracing digital transformation in financial services: From past to future. Sage Open, 13(4), 21582440231214590. https://doi.org/10.1177/21582440231214590

Uzougbo, N., Ikegwu, C. & Adewusi, A., (2024). Regulatory frameworks for decentralized finance (DEFI): challenges and opportunities. GSC Advanced Research and Reviews, 19(2), pp. 116-129. https://doi.org/10.30574/gscarr.2024.19.2.0170.

Von Kalckreuth, U., Bundesbank, D., & Schmidt, T. (2021). Digitalisation and adoption of fintech in Germany: gathering survey evidence on households. http://www.von-kalckreuth.de/Publications/Kalckreuth_Schmidt_Fintech_Diffusion_IFC_Final_Report_07_2020.pdf.

Wang, H., Mao, K., Wu, W., & Luo, H. (2023). Fintech inputs, non-performing loans risk reduction and bank performance improvement. International Review of Financial Analysis, 90, 102849. https://doi.org/10.1016/j.irfa.2023.102849.

Xu, R., Zhu, J., Yang, L., Lu, Y., & Xu, L. D. (2024). Decentralized finance (DeFi): a paradigm shift in the Fintech. Enterprise Information Systems, 18(9), 2397630. https://doi.org/10.1080/17517575.2024.2397630.

Zetzsche, D. A., Arner, D. W., & Buckley, R. P. (2020). Decentralized finance. Journal of Financial Regulation, 6(2), 172-203. DOI: 10.1093/jfr/fjaa010.

Licensed

© 2025 Copyright by the Authors.

Licensed as an open access article using a CC BY 4.0 license.

Article Contents Author Yazeed Alsuhaibany1, * 1College of Business-Al Khobar, Al Yamamah University, Saudi Arabia Article History: Received: 03 September,

Article Contents Author Muhammad Arslan Sarwar1, * Maria Malik2 1Department of Management Sciences, University of Gujrat, Gujrat, Pakistan; 2COMSATS

Article Contents Author Tarig Eltayeb1, * 1College of Business Administration, Imam Abdulrahman Bin Faisal University, Dammam, Saudi Arabia Article History:

Article Contents Author Kuon Keong Lock1, * and Razali Yaakob1 1Faculty of Computer Science and Information Technology, Universiti Putra Malaysia,

Article Contents Author Shabir Ahmad1, * 1College of Business, Al Yamamah University, Al Khobar, Kingdom of Saudi Arabia Article History:

Article Contents Author Ghanima Amin1, Simran1, * 1Department of Biological Sciences, University of Sialkot, Sialkot 51310, Pakistan Article History: Received:

PDF

PDF